Quick Take: Which legit loan apps in the Philippines offer low interest rates?

Here’s a little insider tip, luv—most online personal loans in the Philippines actually come with annual interest rates between 18% to 36%, depending on where you borrow and your credit standing. Sure, some lenders flash lower daily or monthly rates to grab your attention, but don’t get fooled! Always check the effective annual rate (APR)—that’s the real deal when it comes to knowing how much you’ll pay in total. Now, if you want a legit, low-interest loan that doesn’t just save you money but also helps you glow up your credit, the Tonik Credit Builder Loan is the way to go.

With super flexible terms, competitive rates, and an easy-peasy application on the Tonik App (all you need is 1 valid ID and your Tonik account, that’s it!), it’s built for convenience. Plus, Tonik reports your payments to credit bureaus, so you’re not just borrowing—you’re building a solid credit history that can help you reach your future goals. A smart loan with long-term perks? Yes please!

Building good credit is important as it helps you get approved for future loan and credit card applications. Download the Tonik App and apply in just a few taps!

When choosing online loans, it’s easy to be swept away by a high loan amount. Get up to P50K! P150K! P250K! Need a million? How about P5M! All those zeroes can hypnotize you and you’ll be signing that contract before you know it. Luckily, we’re here to snap you back into reality with this handy blog about another important number that you need to carefully consider – the loan interest rate!

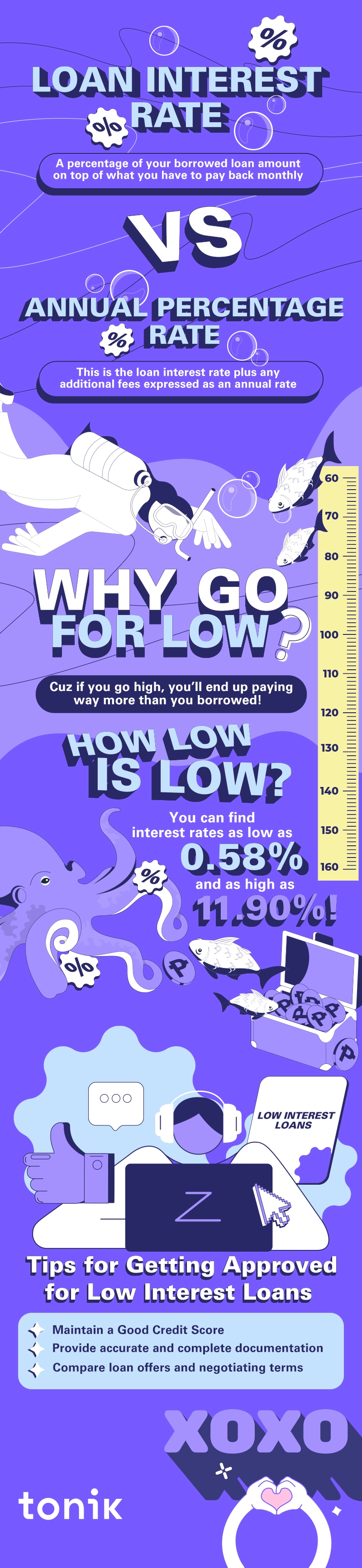

A loan interest rate is what you have to pay for borrowing a loan. It's based on a percentage of the amount borrowed. That means if you get an interest rate that’s super high, you might end up having to pay even more than what you borrowed. Who wants to go through that?

Not you, that’s for sure. Keep reading for a quick overview of online loans with low interest rates in the Philippines!

Tired of High-Interest Loans?

A solid credit history can unlock better loan terms. Start building with Tonik Credit Builder Loan!

Table of Contents

Factors to Consider When Choosing Online Loans

Loan amounts and interest rates aren’t the only factors to consider. Let's get you up to speed with every factor involved so you can make an informed decision and find the best online loans with low interest rates in the Philippines!

Loan Amount and Eligibility Criteria

We all understand how challenging it can be to lend money, even to our closest friends and family. There's always that worry that they might take off without repaying a single centavo. Banks and lenders share a similar concern, which is why they establish eligibility criteria to evaluate borrowers' trustworthiness, especially when it’s for online loans with low interest.

As you strive to build trust with lenders, it's crucial to position yourself for success rather than setting yourself up for failure. That's why it's important to be on the safer side when setting your loan amount. Ask yourself, "Can I comfortably manage to repay this amount consistently each month?" Taking this prudent approach will not only enhance your credibility but also ensure a smoother borrowing experience.

Interest rates and annual percentage rate (APR)

The interest rate represents the percentage charged by the lender for borrowing money, while the annual percentage rate (APR) includes the interest rate plus additional costs or fees, expressed as an annual rate. It's important to note that the APR includes these fees, meaning that even online loans with low interest can have a high APR. These factors can make or break your experience of borrowing as they can impact the overall cost of the loan.

Repayment terms and flexibility

Paying back your loan is a responsibility, but it shouldn't feel like an overwhelming burden. You shouldn't have to drain your bank account to the point where there's hardly anything left for your other expenses (yes, that includes those occasional payday splurges).

Having the flexibility to choose repayment terms that suit your needs can make a world of difference. In the Philippines, loan repayment terms typically range from 12 to 60 months. Before committing to a specific loan, it's always important to check whether the lender can offer a repayment term that you can comfortably manage."

Loan processing time and disbursement

The reason why you’re getting a loan is probably because you need a substantial amount of money as soon as possible. Luckily for you, many online lenders can process applications and disburse the full amounts in as fast as one day. Not to brag, luv, but that’s the whole reason why we called it a Quick Loan in the first place!

Now, let’s talk about the convenience of the disbursement. Again, not to brag, but we disburse all our loans straight into your Tonik Account once they get approved. That means you can get the full amount even while you’re at home using your phone and the Tonik App. You can’t get any more convenient than that!

TOCTop Online Loans with Low Interest Rates

Now let's get to the good part. Let’s take a look at a couple of lenders (including yours truly) and the online loans with low interest rates!

Tonik Digital Bank

Currently, we have Quick Loan and Shop Installment Loan as our non-collateral loans. Quick Loans can be approved and disbursed as fast as one day, while Quick Loan and Shop Installment Loan can be approved and disbursed almost immediately as long as you submit complete requirements.

BillEase

Finally, we have Billease. You can borrow up to PHP40,000 for 2-6 months for new customers, or 2-24 months for repeat customers at an interest rate of 11.90%. They take the “ease” in “Billease” seriously, as they only ask for a few requirements like a valid ID, proof of income, and proof of billing. Once approved, you can expect the amount to be disbursed into your BillEase app in as quick as one day!

TOCComparison of the Best Online Loan Providers in the Philippines

And now, here are the lenders, their products, and the details you need to know. Get the necessary info about these online loans with low interest in the table we made for you below!

| Lender | Product | Max. Amount | Lowest Monthly Interest Rate | Loan Terms | App Store Rating | Google Play Store Rating |

|---|---|---|---|---|---|---|

| Tonik Digital Bank | Quick Loan | PHP20,000 | 4.24% | 6-12 months | 4.5 | 4.5 |

| Shop Installment Loan | PHP100,000 | 4.50% | 3-12 months | |||

| BillEase | Cash Loan | PHP40,000 | 11.90% | 2-6 months for new customers or 2-24 months for repeat customers | 4.6 | 4.7 |

Tonik Digital Bank offers higher loan amounts, longer repayment periods, and lower interest rates compared to BillEase, providing borrowers with more flexibility and favorable terms. Tonik also stands out with its diverse range of loan options, making it easier for customers to find a suitable loan for their needs.

BillEase, on the other hand, is unique in that it focuses solely on smaller loan amounts, streamlining the requirements and ensuring quick disbursement. This simplified process could be appealing to first-time borrowers.

Remember that aside from the factors mentioned, it's crucial to take into account your own needs and personal preferences when making a decision.

TOCTips for Getting Approved for Low-Interest Loan Rates

And now, here are the lenders, their products, and the details you need to know. Get the necessary info about these online loans with low interest in the table we made for you below!

Maintain a Good Credit Score

Since lenders don’t know their customers personally, they need an easier way to know if applicants are trustworthy enough for online loans with low interest. That’s what credit scores are for!

Essentially, a credit score sums up your qualities as a borrower. It encapsulates everything from your spending habits to your repaying habits. Make sure to pay debts consistently and on time to keep that credit score up!

Provide accurate and complete documentation

Help banks and lenders help you. It’s simple as that! You want that online loan with a low interest rate? Give them all they need to lend it to you, and you (likely) won’t encounter any problems. Requirements typically include an application form, a government ID, Proof of Income, and a Certificate of Employment.

Compare loan offers and negotiating terms

Remember that you’re not at the complete mercy of these lenders. You’re a customer after all, and they need you so their business can thrive. That’s why you should never be a yes man when it comes to getting loans. Compare and contrast with other online loans (with low interest rates always in mind!), consider your needs and preferences, and put your game face on when you negotiate the terms. Be confident, luv, you got this!

TOCConclusion

Choosing a loan isn’t all about how big the maximum loan amount is. We understand that you might need a big amount of cash ASAP, but you would be doing your future self a huge favor if you carefully consider the interest rate first.

Heads up, though - lenders aren’t just going to give you online loans with low interest. You have to meet their qualifications first. That includes having a good credit score as well as accurate and complete requirements.

Now that you know about low interest rates and even have a couple of options to choose from, are you ready to get a loan?

First, download the Tonik App on your smartphone to grow your savings and apply for loans with just a tap of your finger!

And of course, always have this blog handy to guide you. Good luck, luv!