Online loan scams have become a prevalent issue in the Philippines. In fact, it's now one of the fastest-growing organized crimes not just in the country, but all over the world.

These scammers employ a wide variety of tactics to take advantage of people who are desperate for cash or have financial problems. To avoid becoming a victim of these scams, it’s essential to learn about the different types and how to spot them. Be informed and read this blog!

Why Does My Credit Score Matter?

Lenders use it to assess credit worthiness. Bad credit equals bad loan terms. Want to boost your credit?

What are Loan Scams?

Loan scams are ways in which scammers or fraudsters trick people into giving them money or personal information with the promise of a loan that doesn’t even exist. Online loan scams are commonly done through platforms like websites, social media (this includes messaging apps like Viber, FB Messenger, etc.), and e-mail.

Types of Loan Scams in the Philippines

Online loan scams can come in many forms. Below are a few types that are commonly found in the Philippines.

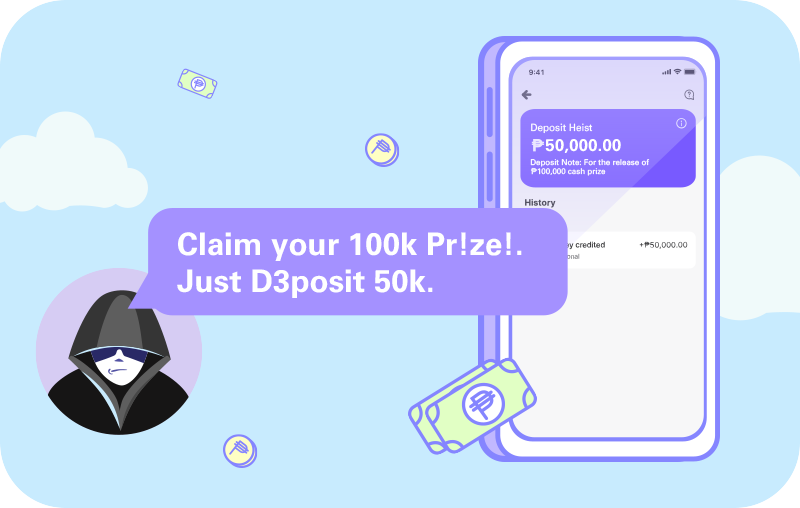

Advance Fee Scams – Fraudsters will ask their victims for an upfront fee or a deposit so they can release the loan amount. Once they receive the fee or deposit, they’ll suddenly disappear.

- Phishing Scams – This one’s called a “phishing” scam because fraudsters use bait to lure their victims in. In this case, the bait is typically a link to a fake website sent via email or an SMS. Victims will then enter their information into the website, thinking they’re applying for a legit loan. But really, they’re just giving all their data away to the fraudster.

- Identity Theft – Some fraudsters steal the personal information of their victims and use that to apply for loans. When this happens, the victim becomes responsible for repaying that loan while the fraudster gets all the borrowed cash.

- Loan Shark Scams - Fraudsters who commit loan shark scams pose as legit lenders to inexperienced borrowers. They then charge ridiculously high interest rates with unreasonable repayment terms. These pile up, forcing victims to pay way more than they need to.

How to Identify Online Loan Scams

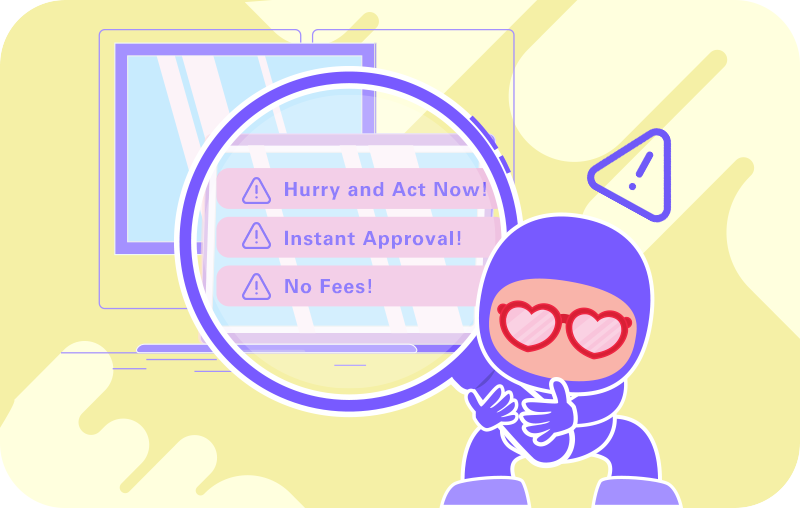

Scammers are getting smarter by the day, but there are usually a couple of signs that you can spot from a mile away. Here are a couple that you should watch out for.

They’re Pressuring You to Hurry and Act Now

Legit lenders know that taking out a loan is no small thing. It’s a commitment that requires plenty of time for consideration. If the lender you’re talking to gives you a strict deadline to sign the contract, then they’re probably doing that so you don’t have time to spot red flags. Don’t fall for this tactic, luv!

They’re Promising Instant Approval – No Questions Asked

Just as you need time to decide on a loan, legit lenders also need time to review your application and consider factors such as your verifiable identity, credit worthiness and debt-to-income ratio. If they ask for none of those things and they tell you that you’ll get the loan no matter what your debt history is like, that lender could be a scam.

They’re Not Transparent About Their Fees

Honesty is key. That’s true for relationships, and that’s true for loans. If the lender you’re eyeing doesn’t have their fees listed on their website – or if they refuse to disclose them even when you ask – then it’s probably best to look elsewhere.

Tips on How to Avoid Online Loan Scams

The first thing you can do to avoid online loan scams is to inform yourself. The fact that you’re reading this right now means you’re in the right direction, luv! Below are a couple more things you can do to avoid online loan scams.

Considering a Co-signer for Added Security

In your journey to find a legitimate loan, considering a joint loan with a co-signer can be a strategic move. Legitimate lenders offering joint loans with co-signers will conduct thorough identity and credit checks, ensuring all parties meet the lending criteria. This level of diligence is rare among scammers, who typically shun situations where multiple borrowers' information must be verified. Opting for a joint loan not only potentially secures you better loan terms but also adds a layer of verification that can deter scammers. Remember, a genuine lender values transparency and will ensure all applicants understand their obligations.

Learn everything there is to know about the lender

Are they regulated by institutions like the Bangko Sentral ng Pilipinas (BSP)? Do they have a customer hotline? How about their customer reviews? How strong is their security? What are their customers saying about them and their services? Make sure to look up and learn about the lender as much as you can.

Create a strong password for your account

Please tell us you’re not the type to use the word “password” as your password. Come up with complicated ones with a combination of upper and lowercase letters, numbers, and symbols. Once you do, don’t share it with anyone. A two-factor authenticator can also help enhance your account’s security!

Access only official websites and apps

When doing research on your chosen lender or when providing your information, make sure to double, triple, maybe even quadruple check that you’re doing it through their official website or app. An easy way to spot a website or app used for phishing? Check for typos (for websites, look at the link first), and notice the quality of the content. If it doesn’t look professionally done to you, it’s probably fake!

In addition to these critical steps, understanding legitimate loan options, like joint loans, can also help you steer clear of scams. Joint loans are when two or more individuals apply for a loan together, pooling their creditworthiness to potentially secure better loan terms. Legitimate lenders offering joint loans will conduct thorough checks on all applicants, mirroring the scrutiny you'd expect with individual loan applications. This process includes verifying identities, assessing credit histories, and ensuring the ability to repay the loan, aligning with regulatory standards.

This diligence is a hallmark of a reputable lender. If you're considering a joint loan, ensure the lender applies the same level of scrutiny to all applicants. Be wary of any entity that promises guaranteed approvals without proper checks, as this is a common tactic among scammers targeting groups of borrowers.

What to Do if You’ve Been Scammed?

Sometimes, no matter how careful we are, we still find ourselves becoming the victim of an online loan scam. If this happens to you, just remain calm because it’s not the end of the world. Here are a few steps you can take:

- Compile all your transactions with the scammer. This includes the equated monthly installment (EMI) receipt. You can use all this if you decide to file a cybercrime report.

- Watch out for suspicious activity in your accounts that the scammer may have gotten a hold of.

- Contact your bank to stop any unauthorized transaction.

- You can also block your bank account/s for now and move your money to a different one for the time being.

How to Determine if an Online Loan Service is Legit

Let’s get into the nitty-gritty. How do you know if a lender really has legit online loans? Here are a few things you can do to find out!

1. Researching the Company

This is where your Googling skills will be put to the test. Look up the lender’s website and check for their company credentials and licenses. Specifically for the Philippines, lending companies should have Certificates of Authority (COA) issued by the Securities and Exchange Commission (SEC). Just like any business, they must also have requirements such as Business Permits and Barangay Clearances.

2. Assessing Website Security

You don’t need to be an expert in cyber security to be able to assess the website security of a lender. The most important factors that you have to look out for are if they have SSL encryption and secure website connections. SSL encryption is a standard security protocol that ensures secure data transmission between the user’s browser and the lender website’s servers. A fast way to check this is if the lender’s website starts with “https://” at the start of it. Review their privacy policy and data protection measures as well to make sure they have your back.

3. Scrutinizing Loan Terms and Conditions

Your days of blindly ticking that checkbox saying you agree to the Terms and Conditions are over. Take the time to really read those blocks of texts, and watch out for hidden clauses and unfair terms they may be trying to sneak in. Before doing any of that, though, make sure you at least have a basic understanding of interest rates, loan fees, and repayment terms.

4. Contacting Customer Support

A good lender would never leave you hanging. Try out their customer care support and see how they respond to concerns and clarifications. Are they quick to respond? Do they seem knowledgeable about their products and services? Do they speak in a professional manner? If you answered no to all those questions, then that’s a red flag!

5. Conducting Online Research and Seeking Recommendations

More often than not, lenders will only show their good side on their website. Get a more honest and unbiased perspective by checking out customer feedback online. You can even join online forums or communities on social media if you want to have a conversation about it, or you can reach out to friends and families for their thoughts.

6. Checking Regulatory Compliance

All legitimate lenders must adhere to established regulations. It's essential to verify your lender's credentials by checking if they are regulated by the Securities and Exchange Commission (SEC) as mandated by the Lending Company Regulation Act of 2007 (Republic Act No. 9474).

Being regulated by the SEC ensures that the lender complies with data privacy laws, anti-money laundering regulations, and consumer protection laws, including those outlined in the Consumer Act of the Philippines. The Consumer Act specifically bolsters borrower protections by requiring lenders to engage in fair practices, provide clear information on loan terms, and respect the rights of consumers. This additional layer of protection under the Consumer Act supports the overall regulatory framework, ensuring that borrowers are treated fairly and ethically in their financial transactions.

7. Trusting Your Instincts

If you can feel it in your gut that this lender is bad news – even after seeing glowing reviews and accreditations – then perhaps it’s best to walk away. After all, luv, you’re the only one who truly knows what’s best for you. However, remember that it’s best to complement that gut feeling with all the information you can get.

Stay Safe, Luv

Online loan scams won’t disappear overnight, but at least we can take them out by not buying into all their schemes. Watch out for every type of online loan scam, steer clear of them, and call them out if you can. If you do get scammed, just keep calm and follow the steps we provided to keep the situation from getting worse.

If you want to see what safe neobanking looks like, download the Tonik App! As the first neobank in the Philippines to be licensed by the BSP, we can assure you that banking is safe with us. Check out our loan products such as Quick Loan and Shop Installment Loan today!

Read Next: Complete Guide to Online Loans in the Philippines