We are addressing the US$140 billion retail deposit and US$100 billion unsecured retail lending opportunities in the Philippines. We believe the existing Filipino banking customers and the 70% of the Filipinos that remain unbanked deserve a better choice – a digital-only bank that is simple, not intimidating, helps them save, all at the click of a button. As the world leader in internet and social media usage, we believe Philippines is ripe for becoming a world leader in digital banking too.

We plan to make it happen. We provide retail financial products, including deposits, loans, savings accounts, payments, and cards on a highly secure digital banking platform.

Innovation is woven into the DNA of our company. We put customers first. We challenge the status quo. We are relentless. We are passionate about improving people’s financial lives through the use of technology.

Tonik is officially the Philippines’ first neobank to secure a digital bank license from the Bangko Sentral ng Pilipinas (BSP). Deposits are insured by PDIC up to ₱1 Million per depositor.

Greg Krasnov

Founder

Founded, built and sold a major consumer finance bank in Eastern Europe, Platinum Bank, backed by global investors. Co-founded four market-leading and award-winning fintech startups in Asia: CredoLab, AsiaCollect, AsiaKredit, SolarHome.

Message from the Founder

At Tonik, we're not just a bank; we're pioneers, entrusted by the Bangko Sentral ng Pilipinas (BSP) as the first neobank to receive a digital bank license. This isn't just a title; it's a responsibility — a commitment to be at the forefront of the financial revolution in the Philippines. Our mission is crystal clear: to transform the Filipino banking experience from the ground up. We're here to make banking not just accessible, but loved by Filipinos, challenging the norms and setting new benchmarks. By being trusted by the BSP to accelerate financial inclusion, we're not only recognized for our innovative approach but also for our commitment to making a real difference in the lives of millions.

We understand that banking can feel impersonal, rigid, and stuck in the past. That's why we're here to bring a refreshing change. With Tonik, banking is no longer about visiting a branch or waiting in lines; it's about living your life uninterrupted, with a financial partner that's always by your side, ready to assist you whenever you need it.

Our unique branding goes beyond aesthetics; it's a reflection of our commitment to build a neobanking relationship that you can fall in love with. Imagine having a romantic partner that's available 24/7, not just through one channel, but through those that you're already familiar with: our app, email, Facebook Messenger, mobile, Viber, or phone. This isn't just about being accessible; it's about bringing financial services to where you are, making sure you feel supported, heard, and valued at every touch. We are always here to listen, and even talk about your Ex(bank) once in a while.

This commitment to revolutionizing banking is further validated by our string of prestigious awards since 2021. Our accolades include the "Best New Digital Bank Philippines 2021" by World Economic Magazine and the "Most Innovative Digital Bank Philippines 2024" by Global Banking & Finance Awards, signifying our leadership in digital innovation. Notably, our dedication to superior customer service was recognized with the "Best Customer Service for Digital Banks 2023" by PDI and Statista, highlighting our relentless pursuit of customer satisfaction. These awards are not mere recognitions; they underscore our unwavering commitment to you, our customers, and our vision to redefine banking in the Philippines.

This is the essence of Tonik – we are not here to be your only bank, we are here to be your bank, a partner that doesn't just hold your money but holds your hand through your financial journey (with free hugs along the way). We're here to revolutionize banking, one happy customer at a time. We want to join you on your journey and change the game together.

Together, towards a brighter financial future,

Greg Krasnov

Founder, TonikLegal Structure

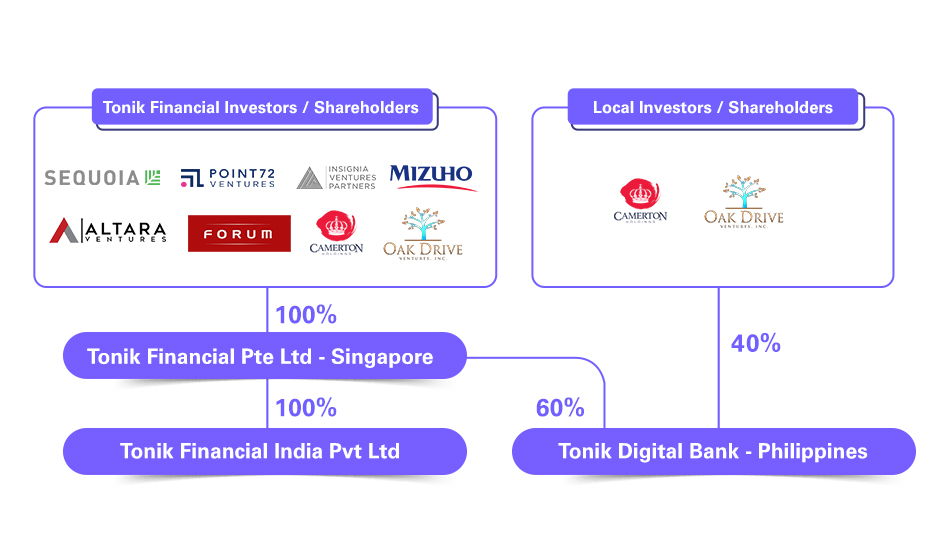

Our holding company, Tonik Financial Pte Ltd, is based in Singapore, and focuses on the product development and technology integration for our digital banking platform.

Our banking operations in the Philippines are conducted by our local subsidiary Tonik Digital Bank Inc, which is regulated by Bangko Sentral ng Pilipinas as a digital bank. In accordance with the local banking law, 40% of our local subsidiary is owned by local investors.

Deposits are insured by PDIC up to ₱1 Million per depositor.