Quick Take 🌟

Tired of banks that nag you to “keep a minimum balance” or else? Same. If you’re hunting for a bank with no maintaining balance, you’re in luck—more options are popping up in the Philippines, and they’re perfect for students, freelancers, side hustlers, and anyone who doesn’t want surprise fees eating into their hard-earned cash💸. And when it comes to digital-first, zero-maintenance, high-interest savings? Tonik’s got your back. 💜

https://staging4.tonikbank.com/sites/default/files/2025-09/banks-with-no-maintaining-balance-hero-thumbnail.png https://staging4.tonikbank.com/sites/default/files/2025-09/infographic-banks-with-no-maintaining-balance.png

Table of Contents

No Maintaining Balance, Explained

Think of it this way: traditional savings accounts are like clingy relationships—they always demand a minimum amount of money to stick around. Fall below that? You get hit with penalties. Yikes.

A savings account with no maintaining balance is the opposite. It’s flexible, forgiving, and doesn’t freak out if your balance dips.

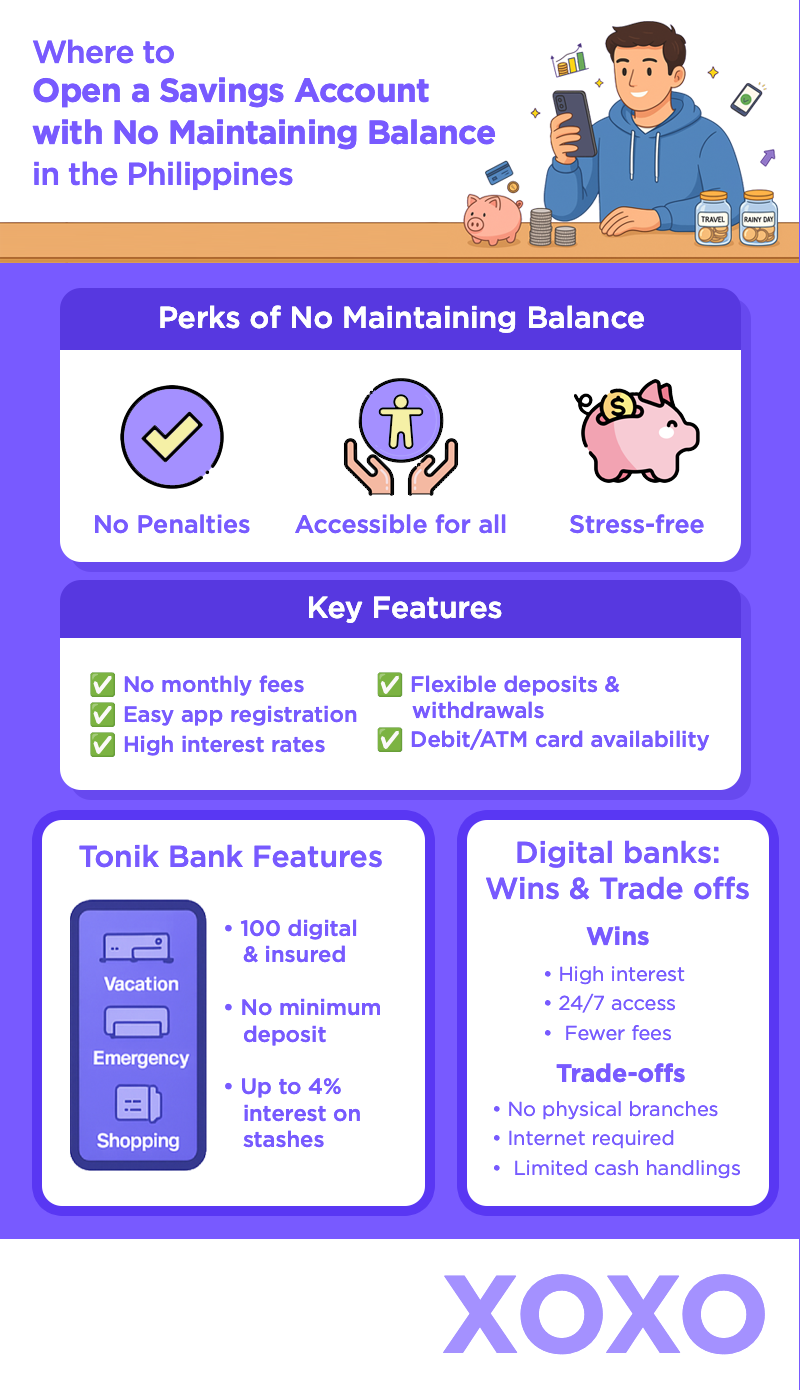

✨ Perks include:

- No scary penalties when you hit ₱0

- Accessible for adult students, freelancers, and daily earners

- Encourages saving because it’s stress-free

Basically, it’s banking that actually fits real life.

What to Look For in a Zero-Maintaining-Balance Account

Not all accounts are created equal. Here’s your cheat sheet before picking a bank with no maintaining balance:

- No monthly fees or deductions

- Simple app-based account opening (no long lines, please!)

- High interest rates to help your money grow while you sleep

- Debit/ATM card availability for easy cash access

- An app that’s easy to use, even on the go

- Flexible deposit and withdrawal options

Tonik: A Bank With No Maintaining Balance Requirements 💜

We’ll be real—you’re here because you don’t want to deal with minimum balance drama. And that’s exactly why Tonik exists.

Here’s why it’s a game-changer:

- 100% digital bank, BSP-regulated & PDIC insured

- No maintaining balance or minimum deposit — just keep your account active by topping up, building Stashes, or simply withdrawing!

- Up to 4.5% interest on your Stashes (personal savings pockets that you can label and use for any goal—from a vacation fund to emergency cash)

- Grow your cash with Time Deposits — lock it in for a fixed period and earn up to 6% interest, hassle-free.

- Zero monthly fees—your money is all yours

- Open an account in minutes with just your phone

- Get a virtual or physical debit card for shopping, bills, and ATMs

💡 Perfect for: Digital natives, side hustlers, and anyone who wants their money to grow without old-school bank hassles.

Digital Banks: The Wins & The Trade-Offs

Why people love them:

- Higher interest than traditional banks

- 24/7 access (no waiting for “banking hours”)

- Fewer fees, less fine print

- All-digital convenience—you literally bank from your couch!

What to keep in mind:

- No physical branches for walk-ins

- Internet is a must

- Limited cash-handling vs. old-school banks

But here’s the deal—most of us are already living digital-first. If you order food, rides, and even movies through apps, why not your banking too?

How to Open a No-Maintaining-Balance Account (The Tonik Way!)

- Download the Tonik app (iOS or Android)

- Register and fill in your details

- Snap a picture of your valid ID for verification

- Get approved—fast

- Start saving with just ₱0 required

That’s it. No paperwork. No “please come back with more documents.” Just a fully digital, no-maintenance account in your pocket.

FAQs

Q. Can I use these accounts for payroll?

Absolutely! Many companies (especially digital-first ones) can credit payroll straight to your account. So yes—you can totally use a bank with no maintaining balance (like Tonik!) for your salary. Just hand your HR team your account details and boom—you’re good to go. ✅

Q: Is my money safe in digital banks like Tonik?

100%! Tonik is regulated by the Bangko Sentral ng Pilipinas (BSP) and deposits are PDIC-insured up to ₱500,000 per depositor. Translation? Your money’s safe, sound, and secure. 🔒

Q: Can I withdraw cash from ATMs?

Of course! Just request a Tonik debit card (virtual or physical) and you’re all set to withdraw or swipe. Easy peasy.

Final Thoughts 🌈

A bank with no maintaining balance is more than just convenient—it’s banking built for today’s lifestyles. No penalties, no stress, just pure freedom to manage your money your way.

And if you want to level that up? Tonik’s savings account with no maintaining balance takes it further with high interest, app-first simplicity, and total flexibility.

Because at the end of the day, banking shouldn’t feel like babysitting your balance—it should feel like freedom, Luvs. 💜