Quick Take: How much should you have in your emergency fund?

We recommend saving three to six months' living expenses, but this varies based on your situation. Consider your job stability, family needs, and existing debts when determining the right amount.

Imagine you're at a fiesta, and suddenly, rain starts pouring down—kind of a bummer, right? Well, financial surprises can feel just like that: unexpected, inconvenient, and sometimes, downright messy. That’s where your emergency fund comes into play, luv! It acts as the trusty umbrella that keeps you dry and comfy.

Let's explore why this financial buffer is not just your rainy day fund, but a must-have to keep your finances sunny and bright!

Table of Contents

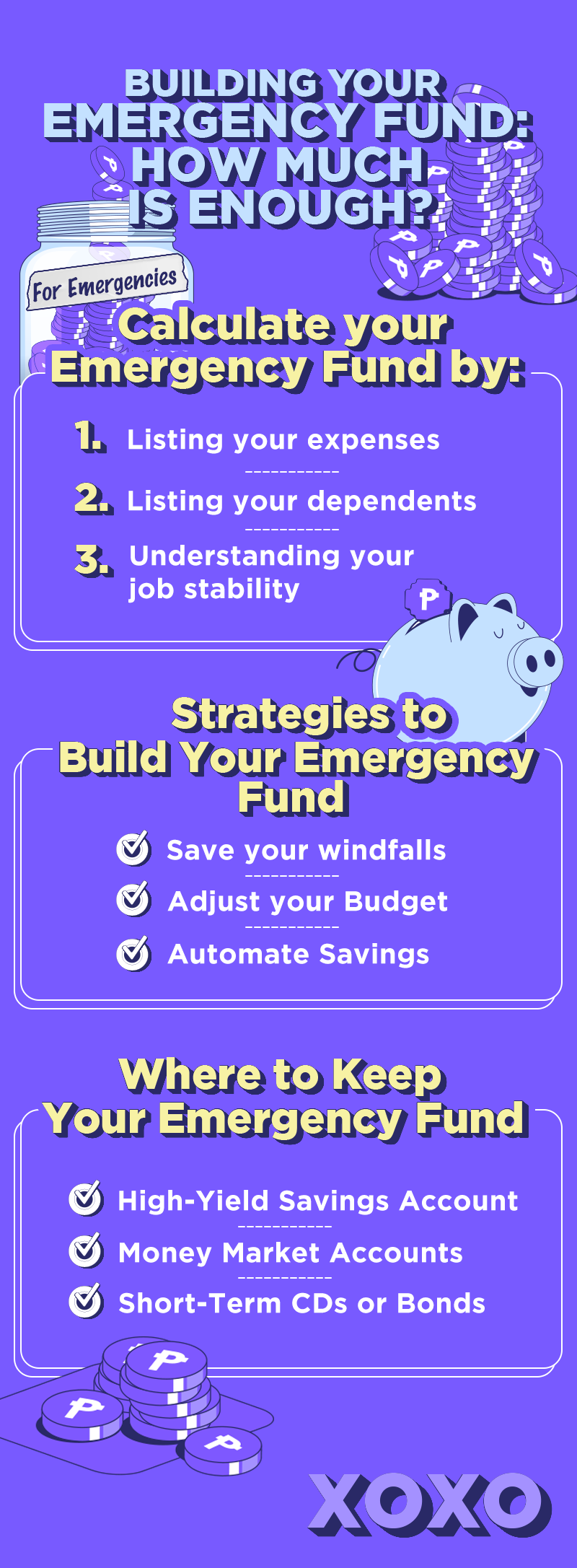

Calculating Your Emergency Fund Needs

So, how big does your financial umbrella need to be? You don’t just pull a random number out of a hat. It’s about tailoring it to your life. Here’s what to look at:

- Monthly Expenses: Whip out those receipts and bills. How much do you need every month for the non-negotiables like rent, food, and, of course, your Wi-Fi?

- Dependents: Got a clan counting on you? The more people under your wing, the sturdier your fund should be.

- Job Stability: If your job is unstable or if the company is pretty unpredictable, better beef up that fund.

Aiming for three to six months’ worth of living expenses is a good start. If you juggle gigs or your industry has tons of ups and downs, consider pushing that to six to twelve months.

Strategies to Build Your Emergency Fund

Starting your fund might seem daunting, but fear not, luv! You can start small, and yes, even today. You can build your emergency fund by:

- Saving your windfalls: Came across some extra cash? A tax return or a bonus, perhaps? Park a good portion of it in your emergency fund rather than splurging on that shiny new thing.

- Budget Adjustments: Time for a budget audit! What’s essential, and what’s more luho than need? Maybe brew your own coffee or cut back on a couple of those streaming subscriptions.

- Automated Savings: Make saving as seamless as sending a good morning text. Set up your bank account to automatically sweep a set amount into your emergency fund each payday.

Where to Keep Your Emergency Fund

This isn’t cash to stash under your bed. You need this money safe but also working a bit for you:

- High-Yield Savings Account: Perfect for easy access and earning more bang for your buck. Check out options like Tonik’s high-yield savings accounts that offer you more juice on your savings.

- Money Market Accounts: Similar access to a savings account but typically with a better yield.

- Short-Term CDs or Bonds: If your cushion is plush enough, locking away a part of it in CDs or bonds can squeeze out a bit more interest.

Maintaining Your Emergency Fund

Keep this fund for true blue emergencies. No, that flash sale isn’t an emergency, luv! Dip into it only when absolutely necessary and focus on rebuilding it if you do. Life’s unpredictable, but your emergency fund shouldn’t be.

The Peace of Mind Worth Every Peso

Having an emergency fund isn’t just about money in the bank; it’s about keeping your peace of mind intact. It's knowing you won't have to scramble or spiral into debt when life decides to spice things up unexpectedly.

But hey, what if you could stretch that safety net even wider? That’s where Tonik’s Credit Builder comes into play. Think of it as your financial backup dancer, ready to step into the spotlight when you need a bit more to cover unexpected expenses. It’s not just any safety net—it’s one that grows with you. The more you use it responsibly, the more you can tap into, making it easier to handle bigger surprises without a sweat.