Life in the Philippines is nothing short of exciting—sunny days, island vibes, and yep, the anticipated typhoons. 🌧️ And while we can’t stop storms and floods from visiting, we can control how ready we are to face them. The best way to do that? Build yourself a trusty emergency fund.

Think of it like your financial raincoat: you might not wear it every day, but when the skies get dark, you’ll be so glad it’s there.

Table of Contents

- Why Financial Preparedness Matters

- Step 1: Understand Your Financial Risks

- Step 2: Build an Emergency Fund

- Step 3: Secure Important Documents

- Step 4: Prepare Digital Access to Finances

- Step 5: Know Your Financial Assistance Options

- Step 6: Get the Right Insurance

- Step 7: Prepare a Financial Go-Bag

- Step 8: Create a Post-Disaster Financial Plan

- Final Reminders

Why Financial Preparedness Matters

Here in a disaster-prone country, we know typhoons, floods, and even earthquakes are part of the deal. But it’s not just homes and roads that get hit—our wallets often take the brunt too. Unexpected hospital bills, lost income, repair costs… the list goes on.

Without a safety net, many families end up relying on debt or delaying important expenses. That’s why building an emergency fund isn’t just smart—it’s non-negotiable.

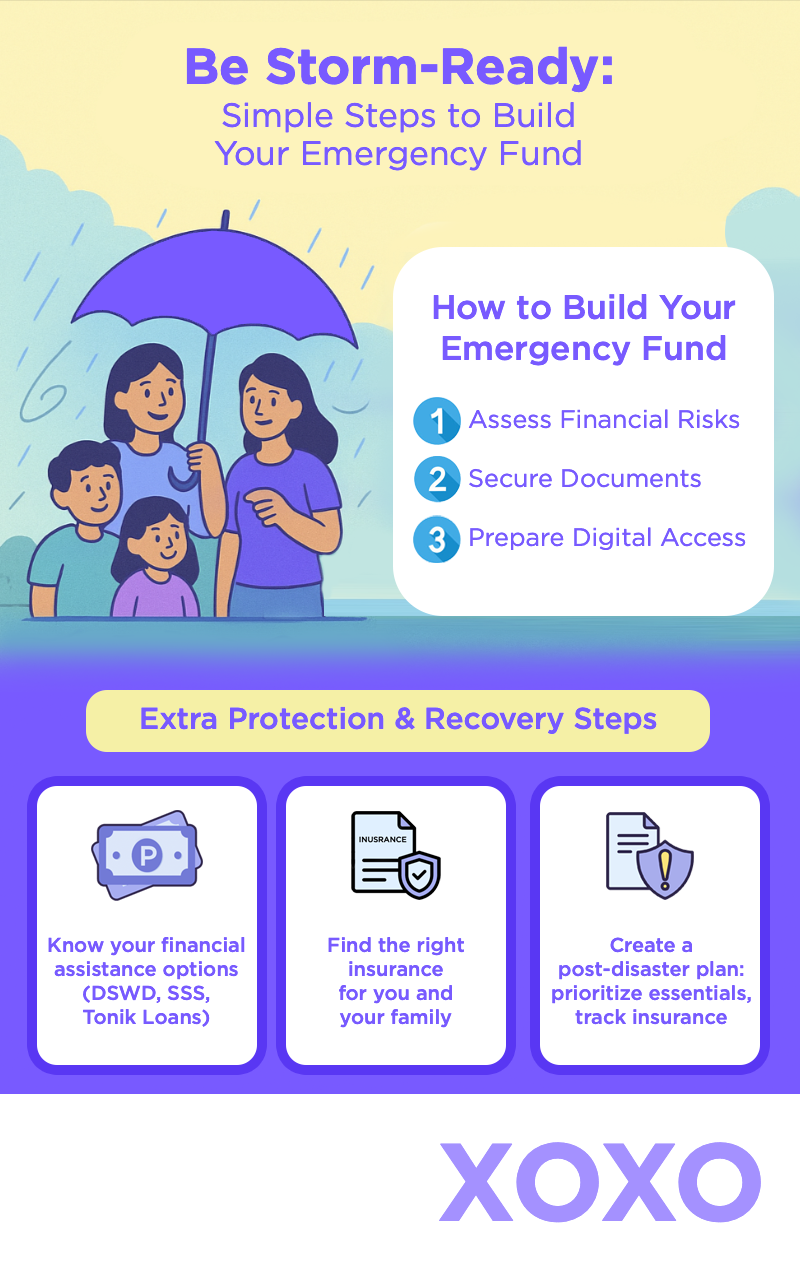

Step 1: Understand Your Financial Risks

Before you start saving, take a moment to evaluate:

- How would a disaster affect your income?

- Do you rely on daily wages or a small business?

- Are your savings or home at risk of flooding?

Knowing your weak points helps you figure out how much your emergency savings need to cover.

Step 2: Build an Emergency Fund

Here’s the golden rule: set aside 3–6 months’ worth of your basic expenses. That way, even if your income pauses, your life doesn’t.

Where to keep it:

- A bank account for easy access

- Mobile wallets (super handy in emergencies)

- Tonik’s Stash feature–separate pockets where you can label and grow your emergency fund

💡 Pro Tip: You don’t need to save it all at once. Start small—set aside ₱50 or ₱100 every payday in your Tonik app. Before you know it, your “rainy day” fund will be ready for any storm. Small steps can grow into life-saving protection!

Step 3: Secure Important Documents

Your wallet isn’t the only thing that’s worth protecting. Keep essentials like:

- Valid IDs

- Insurance policies

- Land titles and property documents

Store them in waterproof pouches, digitize copies, and keep them in cloud storage with offline backups. When disasters strike, future-you will thank you when you don’t have to scramble for a soggy birth certificate.

Step 4: Prepare Digital Access to Finances

No one wants to line up at a bank during a downpour. Here’s how to stay one step ahead:

- Set up mobile banking apps

- Link your accounts to e-wallets for easy transfers

- Back up your passwords and use 2FA for extra safety

Because when ATMs are down, your phone becomes your lifeline.

Step 5: Know Your Financial Assistance Options

Here’s the good news—help is out there. Whether it’s calamity loans from DSWD, SSS, or Pag-IBIG, NGO relief, or LGU support, knowing your options early keeps you from scrambling later.

Need funds fast? Tonik’s Quick Cash Loans has you covered—money in minutes, straight to your account, no long lines, and no mountains of paperwork. With flexible amounts, clear repayment terms, and all-digital convenience, it’s the quick, reliable way to tackle urgent expenses. 🙌💰

Step 6: Get the Right Insurance

Insurance may not sound exciting, but it’s your safety net. Consider:

- Property insurance (for your home or sari-sari store)

- Health and life insurance for your family

- Microinsurance (budget-friendly, perfect for daily earners)

Make sure you know what’s covered in floods, typhoons, or fires. Affordable options exist–sometimes even bundled with your digital bank products.

Step 7: Prepare a Financial Go-Bag

Think of this as your money survival kit. Pack:

- Small bills (in case change is hard to find)

- A backup debit card

- A charged phone with load + power bank

- Copies of IDs and emergency contacts

This way, even if you have to leave home suddenly, you won’t be left empty-handed.

Step 8: Create a Post-Disaster Financial Plan

Once the storm passes, it’s recovery time:

- Prioritize essentials like food, shelter, and medical care

- Track insurance claims and relief funds carefully

- Adjust your budget while rebuilding

- Bounce back faster with Tonik’s PayHinga—a flexible payment holiday service with no interest accrual, built-in loan insurance, and coverage of up to 120% of your loan balance in case of major life events.

Having a plan helps avoid panic spending and keeps your family on track.

Final Reminders 🌈

- Review your financial preparedness plan every year—especially before typhoon season.

- Involve your family so everyone knows the drill.

- Stay updated on local emergency protocols and relief services.

At the end of the day, a little prep now means way less stress later. Your emergency fund isn’t just about money—it’s peace of mind, security, and knowing you’ve got the strength to weather any storm. 🌦️

And remember, Tonik’s got your back. Whether it’s a Stash for savings, a Time Deposit to grow your rainy-day fund, or quick loans when you need them most, we’re here to help you keep your finances storm-ready. 💜