Quick Take: Looking for the best Credit Builder Loan in the Philippines? If your goal is to boost your credit score and build savings at the same time, Tonik’s Credit Builder might just be what you need. Let’s dive into how it works and how it can help you secure a brighter financial future.

If you’ve ever felt like your credit history is holding you back from securing that dream loan or getting better rates, you’re not alone. A lot of Filipinos face the same struggle, especially those with no credit, low credit score, and don’t even know how to check their credit score. But don’t worry, there’s a way to turn things around—enter the Credit Builder Loan.

Table of Contents

- Who are Credit Builder Loans designed for?

- What is a Credit Builder Loan?

- How a Credit Builder Loan works

- Pros and Cons of Credit Builder Loans

- How to choose the right Credit Builder Loan

- Top Credit Builder Loans in The Philippines

- Tips for maximizing the benefits of a Credit Builder Loan

- Start your Credit Builder journey with Tonik Bank

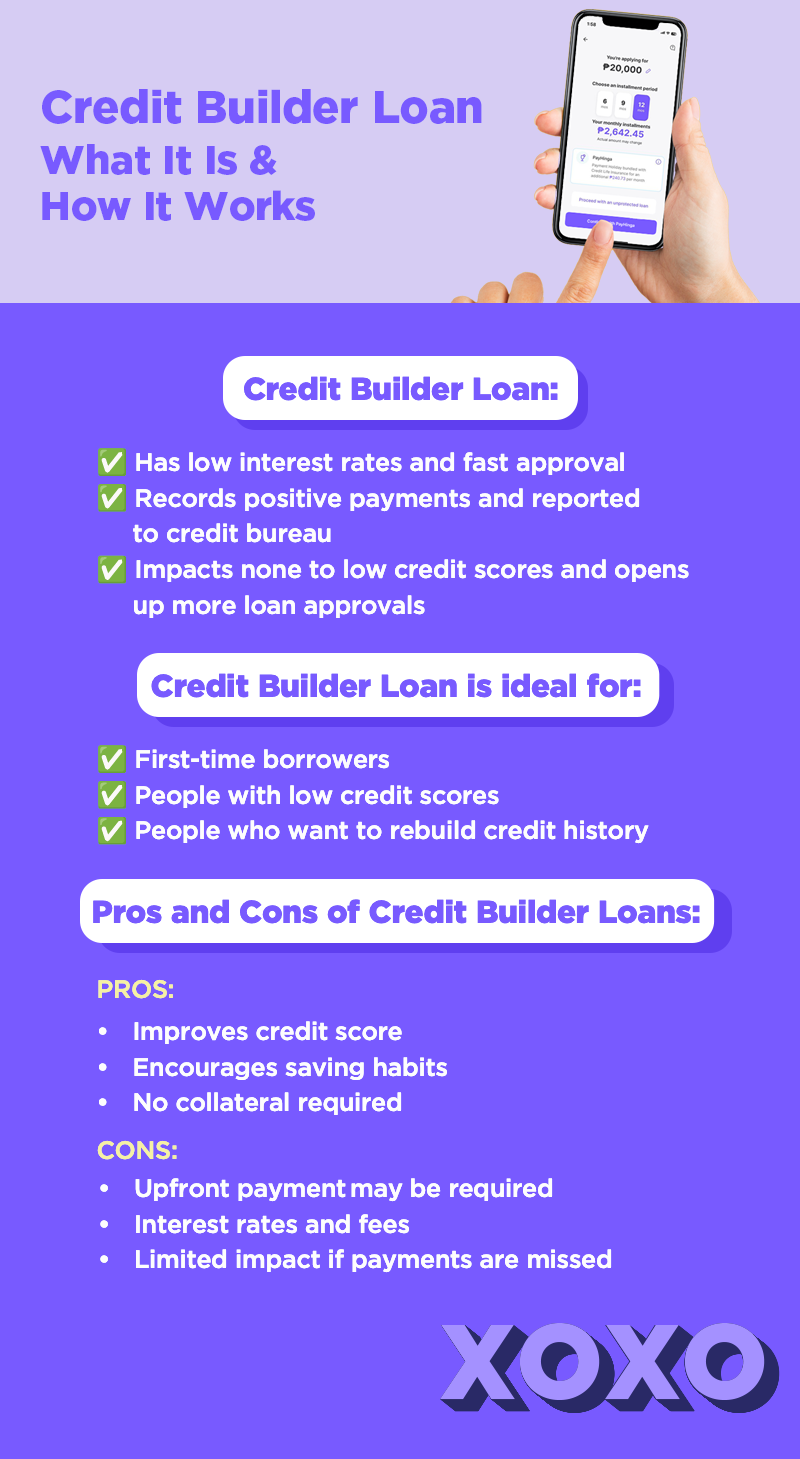

Who are Credit Builder Loans designed for?

Credit Builder Loans are perfect for individuals with no credit or those with poor credit. Whether you’re a first-time borrower or you’ve faced challenges in managing credit in the past, this type of loan helps you rebuild your financial standing.

They’re also gaining traction as more Filipinos realize that improving their credit score isn’t just about borrowing—it’s about building a better future with smarter financial choices.

What is a Credit Builder Loan?

In simple terms, it's a type of loan designed to help you establish or improve your credit score over time. Here’s how it works:

- Definition & purpose: You borrow a small amount, but the loan funds are held in a secured account. You make regular payments over a set period, which helps demonstrate your ability to repay, and builds trust with credit bureaus.

- How it differs from traditional loans: Unlike traditional loans where you receive the money upfront, with a Credit Builder Loan, you don’t get access to the funds until you’ve fully paid it off. The goal here is to prove your ability to manage debt responsibly.

- Improving your credit score: On-time payments are reported to credit bureaus, which boosts your creditworthiness.

How a Credit Builder Loan works

Curious about how the process unfolds? Here’s a simple step-by-step guide:

- Application & approval: You apply for a Credit Builder Loan with a lender or financial institution like Tonik. Approval is usually based on your ability to repay, rather than your credit score.

- Loan funds held in a secured account: Once approved, the loan amount is placed into a secured account. You don’t have access to it just yet, but it’s there, earning interest as you make payments.

- Making fixed monthly payments: You’ll make fixed, monthly payments towards the loan. This helps establish a record of positive payments, which is reported to credit bureaus.

- Loan completion & fund disbursement: After completing the term, you’ll receive the loan amount back (minus any fees). Plus, you’ll have a better credit score!

- Credit score impact: By consistently making payments on time, you’ll see an improvement in your credit score, opening up better opportunities for future loans or credit lines.

- Typical loan terms: Loan amounts typically range from ₱5,000 to ₱30,000, with terms of 6 to 12 months and interest rates usually lower than those of credit cards or payday loans.

Who should consider a Credit Builder Loan?

So, is this type of loan right for you? Here are a few scenarios where it can work wonders:

- First-time borrowers: If you’ve never taken out a loan or used credit, this is a great way to start building your credit history.

- Individuals with a low credit score: If you’ve made some financial missteps in the past, this loan helps you demonstrate your ability to repay debt and rebuild your credit score.

- People looking to rebuild their credit history: Whether you’ve fallen into debt or missed payments, a Credit Builder Loan is a strategic tool to get back on track.

Pros and Cons of Credit Builder Loans

Like anything, Credit Builder Loans have their pros and cons. Let’s weigh them out:

Pros:

- Improves credit score: Timely payments help build a strong credit history.

- Encourages saving habits: You’re essentially saving while paying off the loan.

- No collateral required: Unlike some loans, you don’t need to risk your property to get started.

Cons:

- Upfront payments may be required: Some lenders may require an initial deposit or fee.

- Interest rates and fees: While usually lower, there can still be fees attached.

- Limited impact if payments are missed: Missing payments can negatively impact your credit score.

How to choose the right Credit Builder Loan

When choosing the right loan, there are a few factors to consider:

- Interest rates: Make sure the rates are manageable and compare offers from different lenders.

- Loan terms: Look for loans with flexible terms that suit your financial situation.

- Fees: Be mindful of any extra fees or charges that could add to your loan cost.

- Lender requirements: Some lenders may have eligibility criteria. Check to see if you meet the requirements before applying.

Top Credit Builder Loans in The Philippines

Here’s where Tonik comes in! Our Credit Builder Loan offers competitive rates, transparent terms, and the flexibility you need to start building your credit. More on this later.

But if you’re looking for alternatives, you might also consider:

- Loan apps: Some online lending platforms offer short-term credit-building options.

- Secured credit cards: A great way to build credit with a lower risk.

- Personal loans with a co-signer: If you’re struggling to get approved on your own, a co-signer can help.

Tips for maximizing the benefits of a Credit Builder Loan

Want to get the most out of it? Here’s how:

- Make on-time payments: This is the number one way to boost your credit score. Read more about cashless payments here.

- Monitor your credit score: Keep an eye on your progress and see how your efforts are paying off.

- Avoid unnecessary debt: Keep your finances under control during the loan term to avoid undoing your hard work.

Start your Credit Builder journey with Tonik Bank

At Tonik, we believe everyone deserves a chance to build their credit and secure a solid financial future. That’s why we offer the Tonik Credit Builder Loan, a perfect tool to help you improve your credit score while getting the quick and easy loan you need. Not only is the application process simple and fast, but the loan amount can go up to ₱20,000, giving you the flexibility to borrow what you need to kickstart your financial journey.

What makes Tonik’s Credit Builder Loan stand out? Let’s talk about the flexible payment options:

- We understand that life can be unpredictable, so we’ve made sure that you can choose your own installment period — up to 12 months — giving you that much needed cash loan and the flexibility to manage your payments in a way that fits your budget.

- We also offer PayHinga, an add-on service designed for borrowers who may be going through tough times. With PayHinga, you can take a break from your loan payments for up to one month by pushing the payment schedule back, giving you some breathing room when life throws you a curveball.

- Plus, PayHinga comes with Credit Life Insurance provided by Sun Life Grepa Financial, Inc., so you can rest easy knowing you’re covered in case of emergencies.

Whether you’re starting your credit journey or rebuilding your credit score, the Tonik Credit Builder is here to help you every step of the way. With transparent terms, competitive rates, and easy-to-manage payments, there’s no better time to apply and start building a brighter financial future. Apply for the Tonik Credit Builder Loan today and take control of your credit journey!