No immediate need for a loan? No problem, luv! Establishing a good credit history today sets the stage for future financial benefits, helping you secure better deals when it's time for those big life moments.

Your Tonik Account is key to easy credit building. Regular payments, saving with a Stash, and everyday transactions can all contribute to your credit score. This means you’ll be eligible for the loan you need, when you need it.

Take the first step towards a strong financial future. Start building your credit with us, and be ready for whatever comes next.

Regular payment transfers

Topping up

Saving with a Stash

Using our Virtual and Physical Card for your transactions and payments

Start building your credit with us now, and together, we can build a strong financial future!

Meet the no-stress loan that’s 100% committed to you and your money goals: Tonik Credit Builder Loan!

Made for Filipinos to support their credit journey, no matter what stage in life (or love) you’re in.

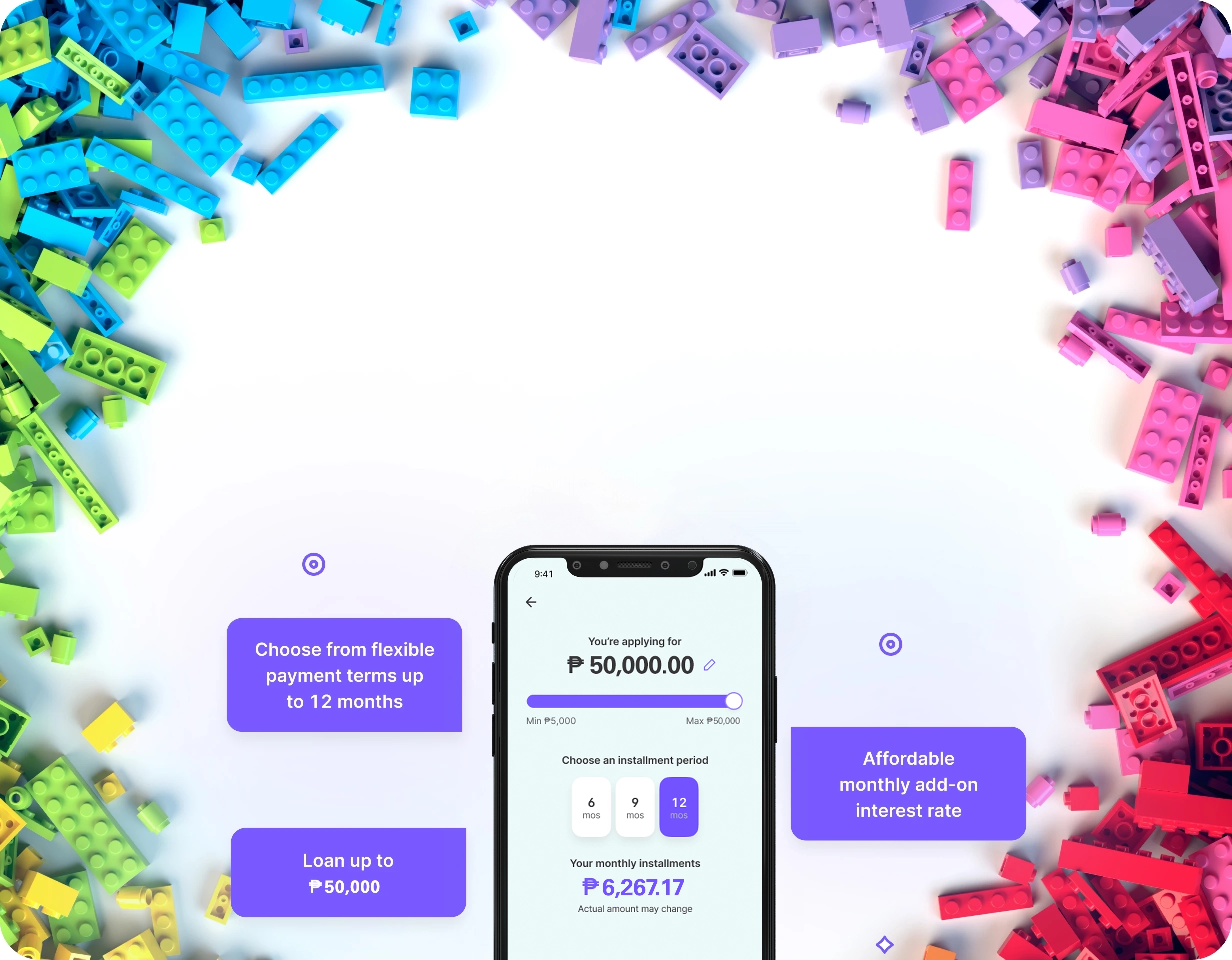

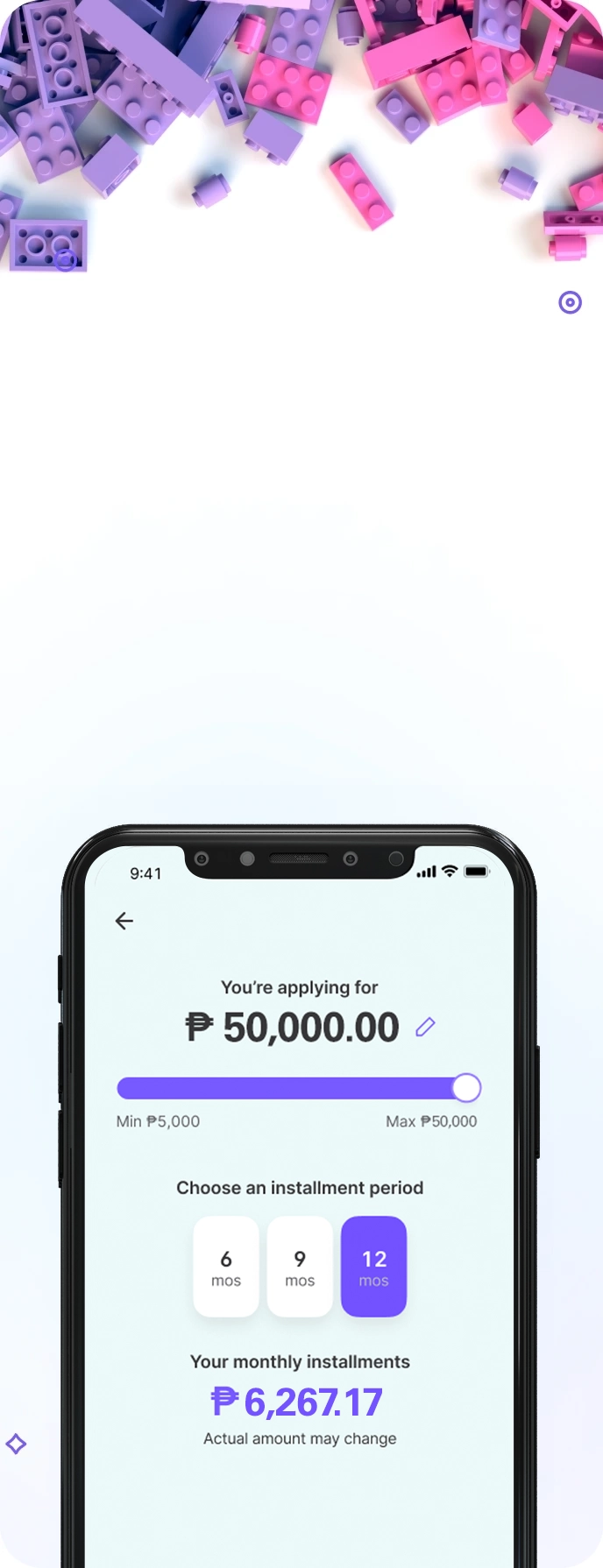

Quickly borrow up to ₱50,000 with Tonik’s Credit Builder Loan to fund whatever you need and boost your credit score too!

Easily apply, make quick payments, and unlock opportunities all through the Tonik App. Yup, no long lines and no hidden catches.

Just fast cash, better credit, and a whole lot of love. Oh, did we mention? We’re BSP-licensed and PDIC-insured. So yeah, we’re pretty serious and secure too – the real relationship you deserve.

More benefits you’ll love:

- Instant approval + real-time disbursement

- No credit history or collateral needed

- Just 1 valid ID + a Tonik Account to apply

- Flexible due dates to match payday

- 6, 9, or 12 month payment terms

- No pre-termination fees

- Easy repayment options in-app

Let’s go build your financial future together? One Tonik move at a time.

Complete the onboarding process. Prepare 1 Valid ID. When you have a Tonik Account, click the Loans tile and tap on Credit Builder Loan.

Follow all on-screen instructions on the Tonik App screen and fill out the questions.

Confirm your loan details, accept the offer if you agree, and virtually sign the necessary documents.

The full loan amount will be disbursed to your Tonik Account in no time. That’s all, luv. Enjoy!

- 23 to 58 years old

- Filipino nationality

- Philippine resident

- Valid ID

- Tonik Savings Account

- Minimal requirements

- Valid Taxpayer Identification Number (TIN) for employed and self-employed

How much do you need?

Max amount ₱50,000

Your monthly installments

Your monthly installments

Actual amount may change

Eligibility and Requirements

- Be in good health

- 18 to 58 years old

- Meet the minimum loan amount requirement

- Fill out required declaration form

PayHinga to your Credit Builder Loan

You can borrow up to ₱50,000 with installment terms of 6, 9, or 12 months.

You must be a Filipino resident aged 23 to 58, have a valid ID, and hold a Tonik Savings Account.

To apply, download the Tonik App, complete the onboarding process, and follow the instructions under the 'Loans' section to apply for the Credit Builder Loan.

The interest rate can be as low as 4.20% monthly add-on rate, depending on your chosen installment term.

The process is fast and fully online. Approval can typically happen within minutes after completing the application, provided all requirements are met.

Once approved, the full loan amount will be disbursed to your Tonik Account quickly.

You can repay your Tonik loan directly from your Tonik Account. Just tap "Pay Now" on the Tonik App Dashboard and select "Tonik Account" as your payment option. The "Pay Now" button will appear 7 days before your due date.

No need to worry about credit scores, luv! Tonik's Credit Builder Loan doesn't require a credit check, making it easier for you to apply.

Good news! You can settle your Credit Builder Loan early without any penalties. Simply go to your Loans Dashboard and tap on the "I want to close the loan" button. Just ensure you have enough balance to pay it off in full.

Unfortunately, luv, you cannot change your due date and loan terms until you have finished repaying the full amount of your Credit Builder Loan. If you haven't taken out a loan yet, make sure you set the right repayment date that allows you to manage your finances.

The Credit Builder Loan offers a monthly add-on interest rate as low as 4.20%, with payment terms of up to 12 months. Keep in mind that the actual rate may vary based on your chosen loan terms.

Absolutely! Tonik's Credit Builder Loan is designed for those with limited or lower credit scores. You can borrow up to ₱50,000 and improve your credit history for future needs.

Yes, you can reapply. However, approval depends on our analysis of your application data and concerns. Some applicants may be approved upon reapplication, while others may not. We appreciate your understanding.

Hope this helps, luv! XOXO