💡 Quick Take: Here’s the Truth About Credit Blacklisting

What is credit blacklisting? 🚨

Being “blacklisted” means lenders and credit bureaus have flagged your account for not-so-nice credit behavior—think missed payments, unpaid loans, or maxed-out credit.

Good news: it’s not a lifetime ban, but it can make getting new credit tougher.

How do you know if you’re blacklisted?

Check your credit report! You can request one from the Credit Information Corporation (CIC) or major PH credit bureaus like TransUnion, CRIF, or CIBI. Knowledge = power

Signs you might be on the naughty list:

- Late or missed payments ⏰

- Unpaid debts or defaulted loans 💸

- Accounts sent to collections 📉

- Court judgements tied to your name ⚖️

Can you move back to the nice list?

Yes, you totally can! 🙌

Start by negotiating with creditors, setting up payment plans, disputing report errors, and rebuilding your credit with consistent, on-time payments.

How long does blacklisting last? ⏳

Negative records usually stay for 3-7 years, depending on the debt and credit bureau. Time heals... especially with good habits.

How to avoid getting blacklisted again:

✔️ Pay on time, every time

✔️ Keep credit usage below 30%

✔️ Check your credit report regularly

Ready for a fresh start?

A Tonik Credit Builder Loan helps you rebuild your credit by reporting on-time payments, so you can go from naughty to nice—and stay there. 💜

Table of Contents

- What is Credit Blacklisting?

- Is Credit Blacklisting Permanent?

- How Credit Blacklisting Affects Daily Life

- How to Check If You Are Blacklisted for Credit in the Philippines

- Interpreting Your Credit Report

- How to Begin Credit Repair After Being Blacklisted

- Practical Credit Repair Roadmap (Step-by-Step)

- Common Myths About Credit Blacklisting in the Philippines

- Preventive Measures to Avoid Being Blacklisted

- How to Build Credit Without a Credit Card

- FAQs About Credit Blacklisting ❓

What is Credit Blacklisting?

Credit blacklisting sounds scarier than it is, but it’s definitely something to avoid. Being blacklisted means you've been flagged due to unpaid loans or credit card debts, making it tough to get approved for new credit.

Credit Reporting Agencies in the Philippines

- CIBI Information, Inc.: The Philippines' first credit bureau, providing comprehensive credit reporting and analytics.

- CRIF: A trusted credit bureau that offers detailed credit information and solutions to help you make informed financial decisions.

- TransUnion: The leading global credit bureau that helps Filipinos access and manage their credit information easily.

Is Credit Blacklisting Permanent?

Short answer: Nope, it’s not forever!

How long do negative records stay? ⏳

Most negative credit entries stay on your credit report for 3-7 years, depending on the credit bureau and the type of account. Late payments may fade faster, while defaults or collections can stick around a bit longer—but they do expire.

Temporary delinquency vs. Long-term blacklisting

Not all credit slip-ups are created equal. 👀

- Temporary delinquency: A few missed or late payments. These can hurt your score but are easier to bounce back from once you catch up.

- Long-term blacklisting: Repeated missed payments, unpaid debts, or accounts sent to collections. These have a bigger impact and take more time to recover from.

So… are you banned forever?

Absolutely not! 🙅♀️

Being “blacklisted” doesn’t mean lenders will shut their doors on you for life. With time, good habits, and consistent on-time payments, you can rebuild your credit and earn back that nice list status.

💜 Tonik tip: Start small, stay consistent, and let positive credit behavior do the talking. Every on-time payment is one step closer to a fresh financial glow-up.

How Credit Blacklisting Affects Daily Life

Credit blacklisting doesn’t just live on paper—it can sneak into everyday moments.

Here’s how it may show up:

🏦 Loan Applications

Banks and lending apps often check your credit report first. If you’re flagged, applications may be auto-rejected or approved with stricter terms. Ouch.

🏠 Housing & Rentals

Some landlords and real estate companies do credit checks before approving tenants. A poor credit record could mean fewer rental options or higher upfront requirements.

💼 Employment (Yes, really!)

Certain roles—especially in banking, finance, or accounting—may require a clean or acceptable credit report as part of background checks.

💳 Future Credit Cards

Expect possible denials or cards with very high interest rates and low limits. Not ideal, but not the end of the road either.

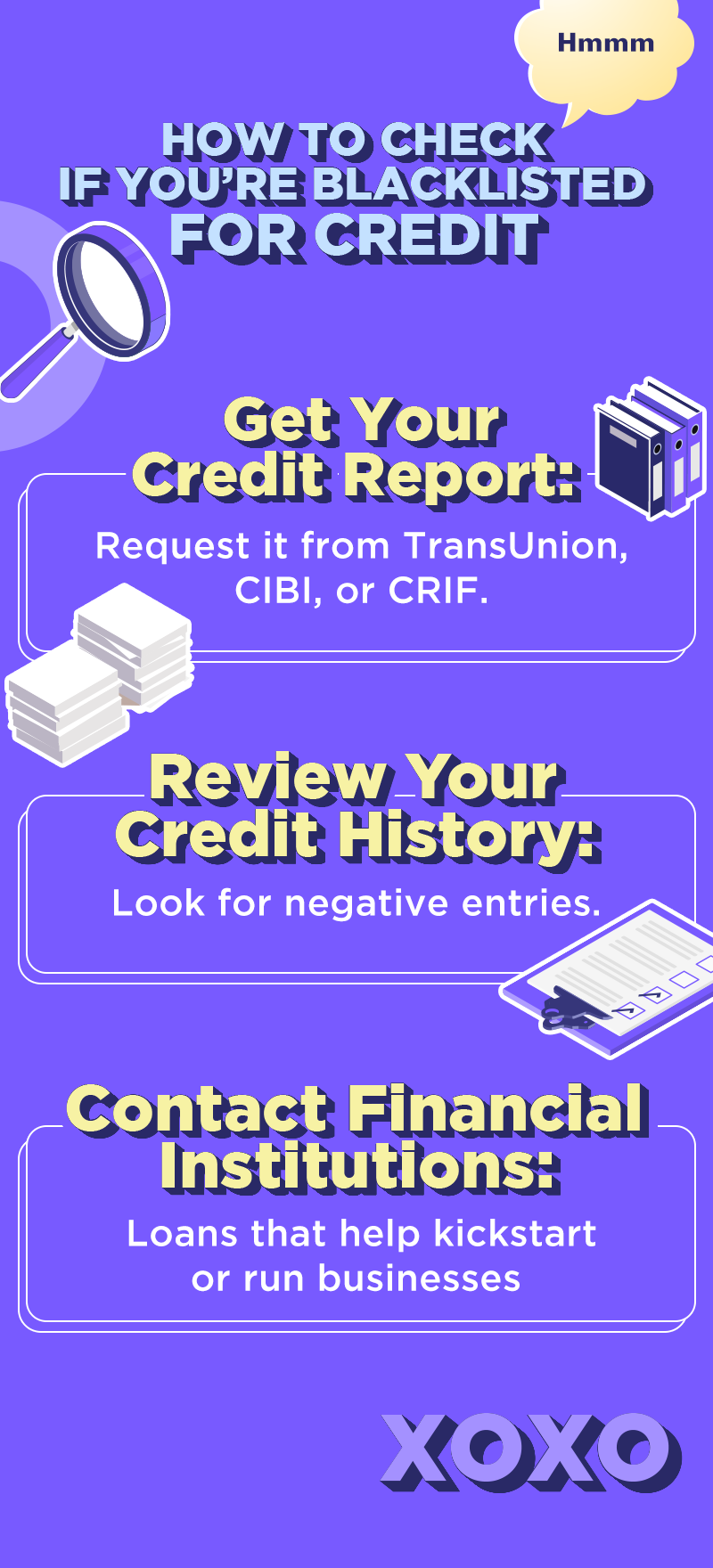

How to Check If You Are Blacklisted for Credit in the Philippines

- Obtain a Credit Report: First things first, get a copy of your credit report. You can request it online or offline from the credit bureaus mentioned. It’s like your financial report card—get it, review it, and take action.

- Review Your Credit Report: Pay attention to the key sections like personal information, credit accounts, and public records. Spotting any negative entries? That might be why you’re blacklisted.

- Contact Financial Institutions: If you’re unsure, ask the experts. Reach out to banks and lenders directly to see what’s up. They can provide insight into your credit status and how to improve it!

- Use Government Resources: Don’t forget about the Credit Information Corporation (CIC). They offer services that allow you to check your credit report too. It’s a good way to see the bigger picture.

Interpreting Your Credit Report

The first step to credit repair is learning how to interpret your credit report. Here are the positive entries and negative entries you should look out for, as well as signs of credit blacklisting.

Positive Entries

- On-time Payments: Regular payments made on or before the due date. These are like gold stars on your financial report card.

- Low Credit Utilization: Using only a small portion of your available credit shows lenders you’re responsible and not overextending.

- Long Credit History: The longer your history of responsible credit use, the better. It shows stability and reliability.

- No Delinquencies: A clean slate with no missed payments or defaults is a strong positive signal to lenders.

Negative Entries

- Late Payments: Any payments made past the due date are red flags, especially if they’re frequent.

- Defaults: Unpaid debts or loans that have been written off by lenders indicate serious financial trouble.

- High Credit Utilization: Maxing out your credit limit or consistently using a high percentage of your available credit can be a sign of financial stress.

- Court Judgments and Bankruptcies: These are serious black marks that suggest significant financial issues in the past.

Recognizing Signs of Blacklisting:

- Multiple Negative Entries: A pattern of late payments, defaults, or high credit usage can lead to blacklisting.

- Flagged Accounts: Accounts that are marked as “delinquent” or “in collections” are indicators of potential blacklisting.

- Contact by Collection Agencies: If collection agencies are involved, it’s a clear sign that your credit is in jeopardy.

How to Begin Credit Repair After Being Blacklisted

It’s never too late for credit repair, luv. Here’s what to do if you’ve been blacklisted.

- Stay Calm and Assess the Situation: Take a deep breath and review your credit report thoroughly to understand why you’ve been blacklisted.

- Negotiate with Creditors: Reach out to your creditors or lenders to discuss your situation. Most are willing to work out a solution.

- Develop a Repayment Plan: Analyze your finances and allocate funds towards paying off your debts first.

- Seek Professional Advice: Consult with a financial advisor to create a debt repayment strategy and manage your finances better. You can also work with credit counselors who can negotiate on your behalf and guide you through the process of repairing your credit.

Practical Credit Repair Roadmap (Step-by-Step)

Think of this as your glow-up guide—from credit stressed to credit blessed. ✨

Step 1: Pull your credit report

Start with the facts. Request your report from CIC, TransUnion, CRIF, or CIBI so you know exactly where you stand. Learn more here.

Step 2: List and categorize all debts

Write everything down and sort them into:

- Active (currently paying)

- Defaulted (missed for a long time)

- In collections (handled by a collections agency)

Clarity = control. 💪

Step 3: Contact creditors and negotiate

Don’t ghost your debts.

Reach out to lenders to ask about settlements, payment plans, or restructuring. Many are open to negotiation if you’re willing to pay.

Step 4: Dispute errors on your credit report

See something that looks off? Fight it. You deserve an accurate record. 🛡️

- Where to file a dispute: Submit your dispute directly with the bureau that listed the error—CIC, TransUnion, CRIF, or CIBI—through their official forms or email channels.

- Timeline for resolution: Most disputes are reviewed within 30-45 days. During this time, the bureau verifies the info with the lender and updates your report if needed.

- Documents to prepare:

- Valid government ID

- Proof of payment or settlement receipts

- Loan or account documents

- Any written communication with lenders

Step 5: Build new positive credit history

Once old issues are handled, it’s time to move forward.

A Tonik Credit Builder Loan helps you rebuild by reporting consistent, on-time payments, giving your credit score a fresh boost. 🚀

Step 6: Monitor your progress quarterly

Check your credit report every few months to track improvements, spot errors early, and stay on the nice list. 😇

Common Myths About Credit Blacklisting in the Philippines

Let’s set the record straight. ⚡

❌ Myth 1: Being blacklisted means you can’t travel abroad

False! Credit blacklisting has nothing to do with immigration. You won’t be stopped at the airport just because you missed a loan payment. Travel plans = safe. Read more about this here.

❌ Myth 2: Your family inherits your blacklist status

Nope! Credit records are individual. Your credit history doesn’t automatically affect your parents, siblings, or kids—unless you share a joint account or co-signed loan.

❌ Myth 3: All banks share one “secret blacklist”

Not true. There’s no single, hidden master list. Banks rely on reports from credit bureaus like CIC, TransUnion, CRIF, and CIBI, plus their own internal assessments.

❌ Myth 4: Paying off one debt instantly clears your blacklist

Not instantly. Settling a debt is a great first step (go you! 🙌), but your credit score improves over time as positive payment history builds and negative records age out.

💜 Tonik takeaway: Don’t let myths scare you. Credit blacklisting isn’t permanent, contagious, or mysterious—it’s manageable. With the right moves and consistent payments, you can rewrite your credit story.

Preventive Measures to Avoid Being Blacklisted

Even before you have to think about credit repair, it’s best to prevent getting blacklisted. Here are some tips from your favorite neobank.

- Pay Your Bills on Time: Use apps or calendar alerts to remind you of payment due dates. Wherever possible, set up automatic payments to ensure you never miss a due date.

- Manage Debts Wisely: Only take on as much debt as you can comfortably repay. We also suggest that you keep your credit usage below 30% of your available limit to maintain a healthy credit score.

- Regularly Check Your Credit Report: Make it a habit to check your credit report at least once a year to catch any errors or discrepancies early. If you find incorrect information, dispute it immediately with the credit bureau to have it corrected. Finally, keep track of any changes in your credit report and understand what they mean for your credit health.

How to Build Credit Without a Credit Card

No credit card? No problem. You can still build a solid credit history with these smart alternatives:

✅ Tonik Credit Builder Loan

Designed for credit newbies and rebuilders, this loan helps you create positive credit history by reporting consistent, on-time payments to credit bureaus. Simple, safe, and confidence-boosting. Learn how to maximize the benefits of a Tonik Credit Builder Loan here.

✅ Secured loans backed by savings

Some loans are secured by your own savings or time deposit. Since the risk is lower for lenders, approval is easier—and every on-time payment helps strengthen your credit profile.

✅ Bills and utilities (when reported)

Paying your electricity, water, internet, or mobile bills on time can help—if the provider reports payment behavior to credit bureaus. Another reason to never miss a due date.

✅ Salary loan repayments

Company-sponsored or salary-deducted loans are another way to build trust with lenders. Regular, on-time repayments show financial responsibility and boost your credit standing over time.

🌟 Credit-building isn’t about how big your loan is—it’s about how consistent you are. Start small, pay on time, and let your good habits speak for you.

FAQs About Credit Blacklisting ❓

Q: How do I know if I’m blacklisted for credit in the Philippines?

A: You’ll only know for sure by checking your credit report from the Credit Information Corporation (CIC) or bureaus like TransUnion, CRIF, or CIBI. If you see missed payments, defaults, or collection accounts, lenders may view you as “blacklisted.”

Q: Can I apply for a new loan if I’m blacklisted?

A: Yes—but approvals may be harder. 😬 Some lenders may reject applications, while others offer loans with stricter terms or higher interest. Credit-building products can help you restart.

Q: Does credit blacklisting affect my family?

A: Nope! Credit records are personal. Your family won’t be affected unless they’re co-borrowers or guarantors on your loan.

Q: How long does blacklisting last in the Philippines?

A: Negative records usually stay on your credit report for 3-7 years, depending on the type of debt and the reporting bureau. They don’t last forever.

Q: Can I get removed from the blacklist by paying my debt?

A: Paying or settling a debt helps a lot! But it doesn’t instantly erase past records. Your report updates over time as positive payment history builds. 👍

Q: Is there a government list of blacklisted borrowers?

A: No secret list here. There’s no single government “blacklist.” Lenders rely on data from credit bureaus and their own internal risk checks.

Q: Will being blacklisted affect overseas job applications?

A: Generally, no. Most overseas employers don’t check Philippine credit reports. However, some high-level finance roles may include background checks.

Q: Do foreign embassies check Philippine credit scores for visas?

A: Nope. Embassies focus on travel documents, finances, and intent—not local credit scores. Your credit report won’t block your visa application.

Q: Is there a Statute of Limitations on debt in the Philippines?

A: Yes. Certain debts have legal time limits for filing court action—but the debt may still appear on your credit report until it expires under bureau rules. ⚖️

💜 Tonik takeaway: Credit blacklisting sounds scary, but once you know the facts, it’s manageable. Stay informed, take action, and remember—your credit story can always be rewritten, Luv.