Credit is the key to unlocking new opportunities in life. Need to take out a loan for a car? Grow your credit. Want a new credit card to help with daily expenses? Grow your credit.

So, what happens if your credit isn't up to par? Or worse: What if you're blacklisted for credit? To quote a certain iconic movie: “She had me at my worst. You had me at my best. Pero binaliwala mo ang lahat...”

Don’t worry, luv. It’s not the end of the world. You still have one more chance with credit repair!

Table of Contents

What is Bad Credit?

Bad credit occurs when your credit score drops due to negative financial behavior.

These can include late payments, defaults on loans, high credit utilization, and even too many credit inquiries.

Simply put, bad credit tells lenders that you're a risky borrower, which can make it harder to get approved for loans, credit cards, or even rent an apartment.

What are the Effects of a Bad Credit History?

Aside from having a hard time getting approved for loans and credit cards, bad credit can have a wider impact on your life.

It can result in higher interest rates on loans, difficulty in securing housing, and even potential job denials if employers check your credit as part of their hiring process.

In the long run, poor credit can cost you thousands of pesos and limit your financial freedom, making credit repair a critical step.

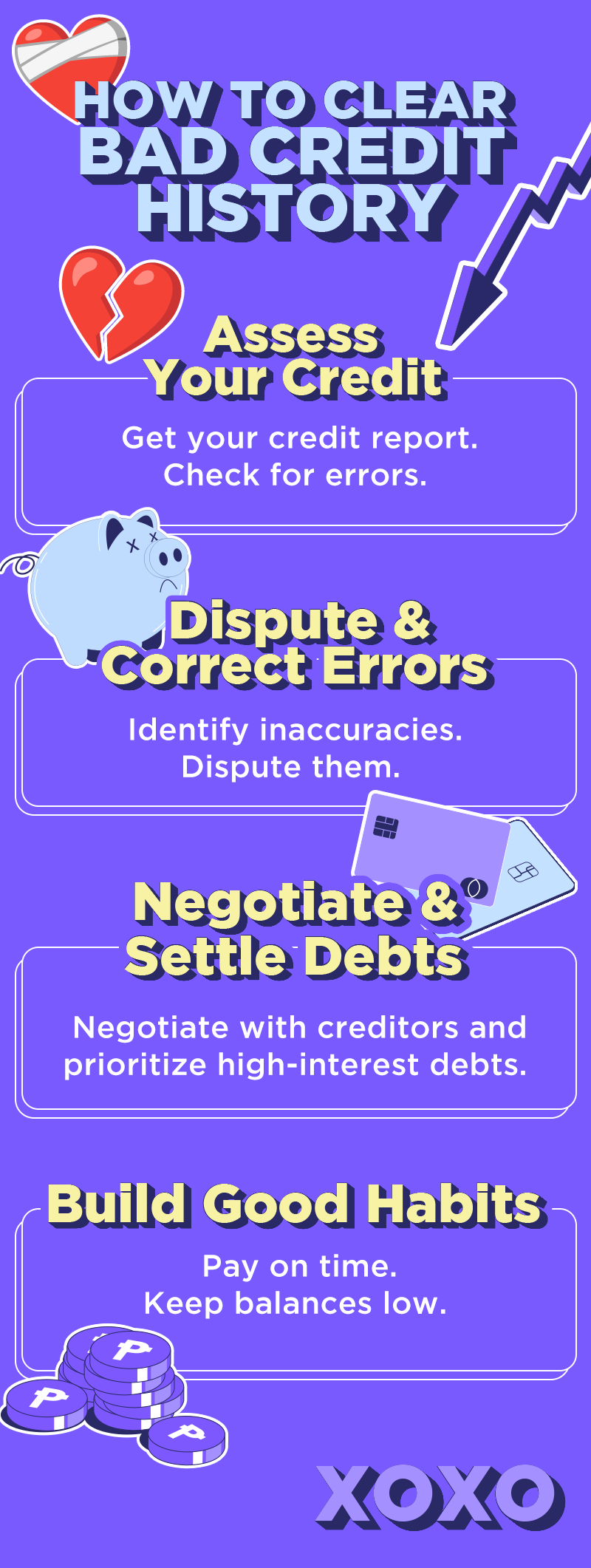

Assessing Your Credit Situation

It all begins here, luv. Here’s how to assess your credit situation:

- Get Your Credit Report: Start by obtaining your report from TransUnion, CIBI Information, Inc., or CRIF.

- Review for Errors: Check the report for any errors or negative entries.

- Spot Inaccuracies: Identify any incorrect information.

- Dispute Errors: Dispute inaccuracies with the credit bureaus.

- Ensure Corrections: Follow up to confirm errors are corrected.

How to Repair Bad Credit

If your credit history doesn’t look good after your assessment, don’t panic. Stay calm and go straight to credit repair mode.

- Dispute Inaccuracies: Identify and dispute errors on your credit report with the bureaus. Follow up to ensure corrections are made.

- Negotiate with Creditors: Contact creditors to negotiate better repayment terms or settlements. Always get agreements in writing.

- Settle Debts: Focus on paying off high-interest debts first. Consider debt consolidation to manage payments more easily.

- Develop a Repayment Plan: Create a budget with a realistic repayment plan. Use automatic payments to avoid missed deadlines and track your progress.

Building Good Credit Habits

Once you pull off credit repair successfully, it’s time to make sure that you won’t need to do it again. Start building good credit habits!

- Pay Bills on Time: Ensure all payments are made by their due dates.

- Keep Balances Low: Maintain low balances on your credit cards.

- Avoid Unnecessary Credit: Refrain from applying for credit you don’t need.

- Practice Responsible Credit Use: Focus on using credit wisely to maintain a healthy financial future.

Utilizing Credit Repair Services

Credit repair can be overwhelming, so don’t hesitate to ask for help when needed. You can use credit repair services, but know the pros and cons first.

Pros of Credit Repair

- Access to professionals who understand the complexities of credit repair.

- Professionals handle disputes and negotiations, saving you time.

- Guidance throughout the process to improve your credit effectively.

Cons of Credit Repair

- Credit repair services can be expensive, adding to your financial burden.

- There’s no guarantee that the service will successfully improve your credit.

- The industry can attract fraudulent companies, so caution is necessary.

Tips for Choosing a Reputable Credit Repair Service

- Check Credentials: Verify the agency’s accreditation and certifications.

- Read Reviews: Look for customer testimonials and independent reviews.

- Get Clear Terms: Ensure the service offers transparent pricing and a clear contract.

Know Your Legal Rights

Even if your credit history has hit rock bottom, don’t forget that you have rights under Philippine law, such as the Data Privacy Act and the Fair Credit Reporting Act.

If you believe your rights have been violated, take the necessary steps to protect yourself and rectify the situation. Knowing your legal protections is a crucial aspect of credit repair.

Preventive Measures for Future Credit Health

To keep your credit healthy, regularly monitor your credit report and build an emergency fund to avoid future financial hiccups.

Educating yourself on credit management and financial literacy will also help you make informed decisions and avoid the need for future credit repair.

Can You Erase Bad Credit History?

While it's tempting to seek a quick fix, bad credit history can't simply be erased. However, by following the steps outlined in this guide, you can gradually rebuild your credit and unlock better financial opportunities through dedicated and consistent credit repair efforts.

Taking control of your credit is vital for your financial well-being. By understanding the importance of good credit, assessing your situation, and proactively repairing any issues, you can pave the way for a brighter, more financially secure future.

If you want to make sure that your credit is secure, you should start building today with

Tonik Credit Builder Loan! Download the Tonik App and apply today.