Quick take

Building credit doesn’t have to be a headache. With the Tonik Credit Builder Loan, you can start building or improving your credit score with ease and confidence. It’s designed to help you create a strong credit history by making regular payments that are reported to credit bureaus, all while ensuring that the loan fits within your budget. Ultimately, this budget-friendly loan is how to qualify for a loan in the future too.

What’s great about Tonik’s Credit Builder Loan is its flexibility—just select the amount that works for you, and as you pay it off, you’ll be strengthening your credit score over time. Plus, applying is quick and simple through the Tonik App! Wondering how to qualify for a loan to start building your credit? Let us walk you through the process!

Table of Contents

More than just a loan

Building a solid credit score is super important, especially here in the Philippines, where your credit history can affect everything from your loans to your ability to rent a place. But if you’re just starting out or want to improve your score, no worries—you’re not alone! The good news is, there are ways to build credit even if you’re starting from scratch. That’s where a Credit Builder Loan comes in.

If you’re wondering how to qualify for a loan to start building your credit, a Credit Builder Loan is the perfect way to get started. It’s simple, it’s straightforward, and with Tonik, it’s all just a few taps away. So let’s walk you through how to qualify and apply for one!

Understanding Credit Builder loans

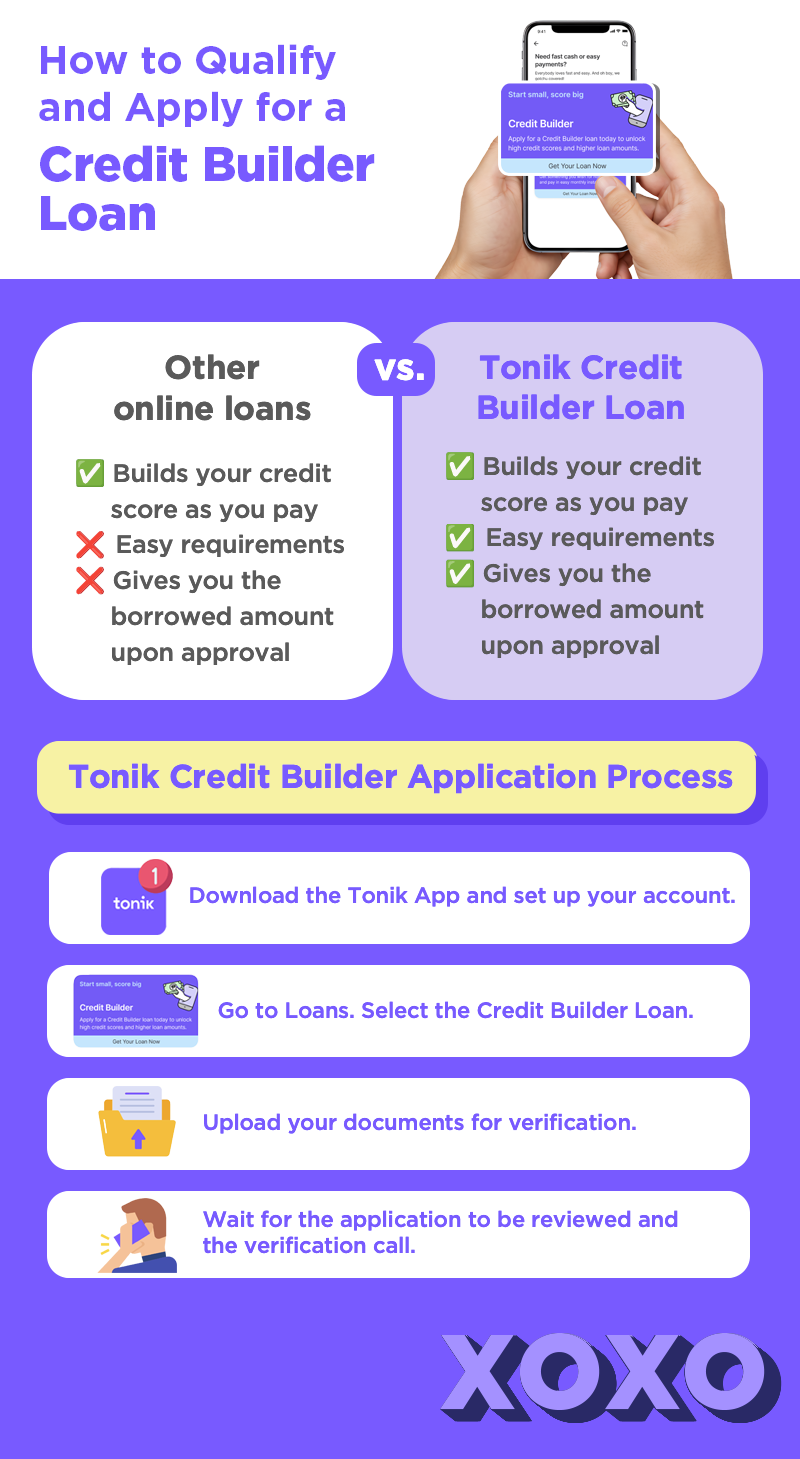

So, what exactly is a Credit Builder Loan? Well, Tonik’s Credit Builder Loan is a bit different from the traditional ones you might have heard of. Usually, with a standard Credit Builder Loan, the loan amount is held in a secured account, and you make payments over time without ever getting access to the cash. While that’s still a good way to build credit, Tonik goes one step further.

With Tonik's Credit Builder Loan, you get access to the loan amount right away! This means you’re not just building credit, but you’re also getting the cash you need up front. In case you’re intimidated by big loan amounts, you’ll be relieved to know that Tonik’s Credit Builder Loan initially goes up to only P20,000, making it ideal for loan beginners.

As you make regular payments, your positive payment history is reported to the credit bureaus, helping boost your credit score over time. It’s a win-win—build credit while having the funds you need now.

Curious about how to qualify for a loan and why Tonik’s Credit Builder Loan is such a great option? You can read more about it here: What’s a Credit Builder Loan? Let’s Dive In. Otherwise, let’s move on.

Eligibility criteria and how to qualify for a loan

Before you can start building your credit, there are a few things you need to know. Here’s what you’ll need to qualify for a Credit Builder Loan:

General eligibility requirements:

- Age: You need to be at least 18 years old to apply.

- Citizenship: You need to be a Filipino citizen or a legal resident of the Philippines.

- Legal residency: You should be living in the Philippines and have a proof of address.

Financial stability indicators:

- Steady income: Lenders like to see that you have a consistent income, whether it’s from a job or your business.

- Employment status: Having stable employment or a steady income stream makes a difference when applying. And guess what? Tonik’s Credit Builder Loan even allows freelancers or the self-employed to apply!

Required documents:

Here’s what you’ll need to apply and qualify for a loan:

- Government-issued ID: Something like your driver’s license, passport, or any valid ID.

- Proof of income: Pay slips, bank statements, or tax returns—anything that shows you’ve got a reliable source of income.

- Proof of Address: Utility bills, lease agreements, or anything that confirms where you live.

How to apply for a Credit Builder Loan

Choosing where to apply is key. Look for a bank or financial institution that makes things easy and transparent—like Tonik. We’ve got a super simple app that lets you apply for your Credit Builder Loan with just a few taps.

Application process

Here’s how easy it is to apply and qualify for a loan with Tonik:

- Step 1: Download the Tonik App and set up your account.

- Step 2: Go to the loan section and select the Credit Builder Loan.

- Step 3: Upload your documents for verification.

- Step 4: Wait for the application to be reviewed and the verification call.

Things to keep in mind before applying

Before you apply and qualify for a loan, there are a couple of things you should consider:

- Interest rates: Make sure the interest rate is something you’re comfortable with since it affects your monthly payments. Tonik offers competitive loan interest rates that won’t burn a hole in your pocket. Plus, you can use the Tonik in-app calculator to know how much you need to pay on a monthly basis.

- Fees: Take a look at any fees that might come with the loan, like processing fees.

- Loan terms: Check the repayment schedule to make sure it works for you. Don’t forget, it’s important to understand how long you’ll be paying. As much as possible, Tonik schedules your payment date close to your salary date to make it easier for you and ensure that you have enough money in your Tonik Savings Account (TSA) when we automatically debit the amount from your savings. Let’s try to avoid the late payment penalty fee of P500, luvs!

Improving your chances of approval

Tips on improving your credit score

If you want to boost your chances of approval and learn how to qualify for a loan, it’s a good idea to give your credit score a little TLC before applying. Here’s how you can do it:

- Pay bills on time: Your payment history is a huge part of your credit score, so paying your bills on time will go a long way.

- Pay down debt: The less debt you have, the better! Try to reduce any outstanding loans or balances before applying.

- Use credit wisely: Keep your credit utilization low by not maxing out your credit cards. A good rule of thumb is to use no more than 30% of your available credit.

Need more tips on improving your credit score? Check out this post: Credit Score Analysis: Understanding and Improving Your Credit Health.

Double-check your docs

Make sure your documents are all accurate and up-to-date before you hit submit. It’ll help avoid delays in the application process and get you closer to approval when you apply and qualify for a loan.

Financial behavior matters

Even before applying, getting into the habit of paying on time, reducing debt, and being mindful of your spending will only help your chances of approval. Being responsible with your money now will make everything smoother later.

Benefits of securing a Credit Builder Loan

There are so many benefits to applying for a Credit Builder Loan and understanding how to qualify for a loan:

- Build or improve your credit history: By making those on-time payments, you’re building your credit profile little by little.

- Better borrowing options in the future: As your credit score improves, you’ll unlock better loan terms and lower interest rates.

- Financial responsibility: Successfully managing a Credit Builder Loan shows that you can handle credit responsibly, which can open up more financial opportunities down the road.

Common challenges and how to overcome them

Not everyone gets approved right away, and that’s okay! Here are a few challenges you might face and how to overcome them:

- Low income or employment instability: If you don’t have a stable income, it can affect your approval chances. It helps to secure a more stable job or additional source of income before applying.

- Incomplete documents: Missing documents or incorrect information can cause delays, or worse, rejection. Double-check everything to make sure your application is complete and accurate.

- Existing debt: If you have a lot of existing debt, it might be harder to get approved. Focus on paying down some of your debts before applying.

If you’re hitting some bumps in the road, don’t hesitate to reach out. Tonik’s customer support is here to help you out.

Start building credit now!

Now that we’ve given you the lowdown on how to qualify for a loan, ready to start building your credit and securing your financial future? The Tonik Credit Builder Loan is here to help you make it happen. With an easy application process and straightforward terms, you’ll be on your way to a stronger credit profile in no time.

Apply now through the Tonik App and kickstart your credit-building journey today: Tonik Credit Builder Loan.

You’ve got this, and Tonik’s got your back! Let’s take the first step toward better credit together.