Quick Take: Best online lender offering Fast Loan approval in the Philippines?

You can’t go wrong with Tonik Credit Builder Loan. You only need one valid ID and a Tonik Account. In just a few taps, you can kickstart your credit journey and borrow up to P20K for 6, 9, or 12 months!

No matter how financially stable you are, there will come a time when the unexpected happens, and you’ll have no choice but to cough up some cash to pay for it. If you don’t have enough saved up, what do you do then?

Luckily, there are online loans with fast approval that you can get with little to no requirements. Some of them can even be disbursed in a heartbeat.

How do online loans with fast approval work? Read this blog to find out!

Table of Contents

- What are Fast Approval Online Loans?

- Benefits of Applying for Loans with Instant Approval

- How to Apply for Online Loans with Fast Approval

- Step 1: Research and Compare Online Lenders

- Step 2: Check Your Eligibility and Loan Requirements

- Step 3: Pre-Qualify for the Loan (Optional)

- Step 4: Fill Out the Online Loan Application

- Step 5: Submit the Required Documents

- Step 6: Instant Approval Process

- Step 7: Review Loan Terms and Conditions

- Step 8: Receiving Funds

- Step 9: Repayment Process

- Build Credit with Fast Approval Online Loans

What are Fast Approval Online Loans?

Fast approval online loans are loans that you can get in just minutes or hours. Typically, you can apply for them through a digital bank or online loan app, and the funds can be disbursed right to your bank account. They’re super quick and convenient, making them the ideal option for emergencies.

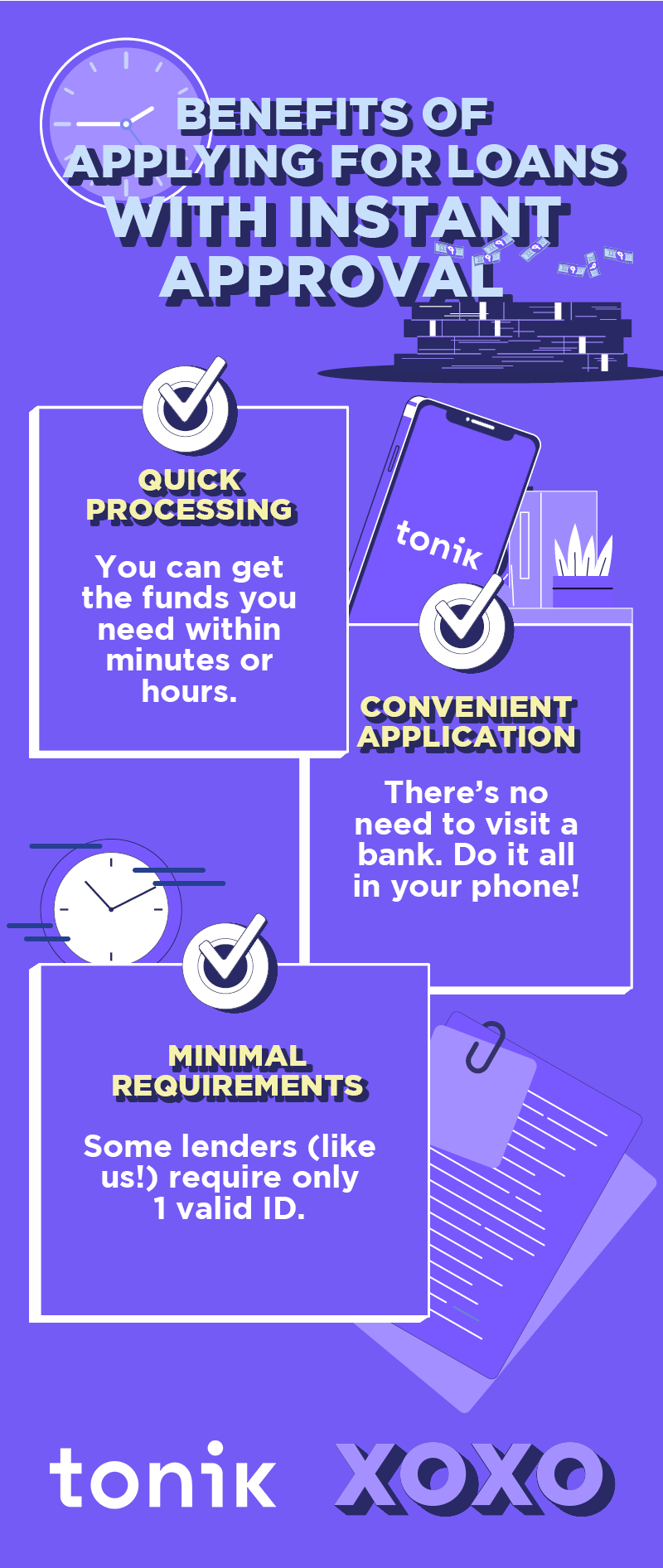

Benefits of Applying for Loans with Instant Approval

- Quick Processing: You can get the funds you need within minutes or hours.

- Convenient Application: There's no need to visit a bank. Do it all in your phone!

- Minimal Requirements: Not to brag (but let’s be real, we totally are) you just need one valid ID and a Tonik Account to get a Tonik Credit Builder Loan!

How to Apply for Online Loans with Fast Approval

Step 1: Research and Compare Online Lenders

When dating, you don’t say “I do” to the first person that catches your eye, right? It’s the same with online loans. You have to get to know your lender first!

You don’t have to go on a bunch of bad dates to find out their red flags. You can visit their websites, read app reviews, or ask for advice on platforms like Reddit.

Important factors to consider are:

- Interest rates: Go for the lender with the most competitive rates.

- Loan terms and repayment periods: Choose a lender with flexible terms so you won’t have such a hard time when it’s time to pay.

- Customer reviews and ratings: See how others experienced the lender/s that you’re eyeing.

- Legitimacy: The fastest way to find out is to check if they’re accredited by regulatory bodies like the Securities and Exchange Commission (SEC) and the Bangko Sentral ng Pilipinas (BSP).

Step 2: Check Your Eligibility and Loan Requirements

Taking out online loans with fast approval is a two-way street. You may want a lender, but do they want you as a borrower?

Save yourself time by checking if you meet a potential lender’s criteria in terms of:

- Minimum credit score

- Income requirements

- Proof of identity and residency

If you meet the eligibility criteria, have your requirements ready! These include (but are not limited to) valid IDs, proof of income, and bank account details.

Step 3: Pre-Qualify for the Loan (Optional)

Pre-qualification helps you understand your chances of approval without affecting your credit score. Some lenders allow you to check if you're eligible before completing a full application.

Step 4: Fill Out the Online Loan Application

If you’re lucky, the lender will only require you to fill out an online application. You can do that in your pajamas! Just make sure that you:

- Accurately enter your personal and financial details.

- Choose the loan amount and repayment terms carefully.

- Avoid mistakes like submitting incorrect information to ensure fast processing.

Step 5: Submit the Required Documents

Upload necessary documents like your ID, proof of income, and bank details. Double-check everything to avoid any delays.

Step 6: Instant Approval Process

Lenders like Tonik use advanced systems to approve loans instantly. However, delays may occur if information is missing or inaccurate. Make sure everything is submitted correctly to speed up approval.

Step 7: Review Loan Terms and Conditions

Almost there, luv! Before you sign that contract, make sure that you’ve read the Terms and Conditions. Pay close attention to the following:

- Interest rates, fees, and repayment schedule

- Any penalties for late payments

Ensure there are no hidden fees, and only accept if you’re comfortable with the terms. If you have any questions, don’t hesitate to reach out. Better safe than sorry.

Step 8: Receiving Funds

Once approved, your loan will be disbursed quickly. Most lenders offer direct deposit to your bank account. That's how we do it at Tonik!

Step 9: Repayment Process

Set up automatic payments or monitor your repayment progress via the lender’s app or website. Tonik, for example, offers a number of payment methods, including one where you just have to top up your Tonik Account at least 7 days before your due date. Talk about effortless!

Now that you know the step-by-step process of getting online loans with fast approval, it’s time to take action.

Build Credit with Fast Approval Online Loans

Apply for Tonik Credit Builder Loan and borrow up to P20K in a flash! Not only is this a quick loan, but it’s also a way for you to build credit.

In case you didn’t know, building credit is essential if you want to borrow more loans in the future.

You ready? Download the Tonik App and apply now!