As cash takes a backseat, e-wallets and digital transfers are stepping up. From bank transfers to mobile wallets, going digital is easier than ever—but safety is key! Here’s your guide to secure online money transfers and the top e wallets in the Philippines.

Table of Contents

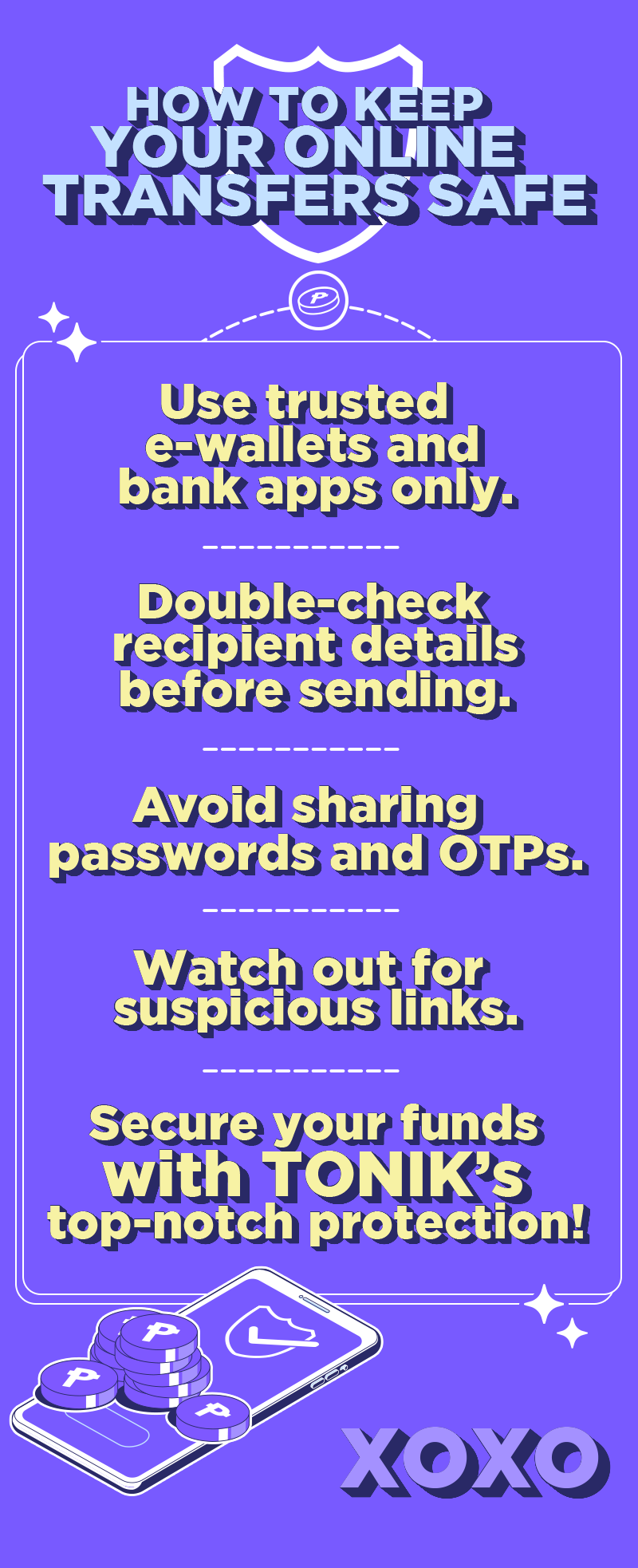

Safety Tips for Online Money Transfers

Keeping your money safe during online transfers is easier than you might think. Here are some essential tips to protect your funds:

- Use trusted platforms: Opt for licensed banks and e wallets to lower the risk of fraud.

- Secure your login information: Avoid sharing your PINs, OTPs, or passwords, and enable two-factor authentication (2FA).

- Verify recipient information carefully: Double-check account numbers and recipient details before hitting send.

- Monitor transactions regularly: Review your account activity to spot any unusual transactions early on.

Bank Transfers

For secure, cashless transfers, banks remain a top choice. Traditional banks and digital banks offer high-security options for online money transfers.

Security Features

Digital banks and traditional banks use advanced security measures like encryption, 2FA, and fraud detection to ensure every transfer is safe. With military-grade encryption and real-time alerts, banks prioritize protecting your personal information.

Popular Banks for Secure Transfers

Here are some of the most trusted banks in the Philippines for secure online transfers:

- Tonik: As the first digital-only bank in the Philippines, Tonik offers military-grade encryption, Face ID biometrics, and 24/7 fraud monitoring to keep your money safe.

- UnionBank: UnionBank’s digital banking platform is known for its secure e wallet integration, two-factor authentication, and instant transaction notifications.

- BPI (Bank of the Philippine Islands): BPI offers secure online transfers with OTPs and encryption for every transaction, ensuring your peace of mind.

Steps for Secure Transactions

- Log in on a secure device: Use a safe network and a device with up-to-date antivirus software.

- Verify details: Double-check account numbers, amounts, and recipient information before confirming.

- Enable notifications: Stay informed about each transaction by activating SMS or email alerts.

- Log out securely: If using a shared device, remember to log out immediately after finishing.

Mobile Wallets

Mobile e wallets make cashless payments fast and easy. Here’s a closer look at the top e wallets in the Philippines:

- GCash: This popular e wallet allows users to send money, pay bills, and make purchases online. With biometric logins and PIN-based security, GCash is one of the top choices for secure cashless payments.

- Maya: Previously known as PayMaya, Maya provides features like money transfers, bill payments, and even cryptocurrency investments. With encryption and instant transaction alerts, Maya is a trusted choice for digital payments.

Payment Gateways and Online Platforms

When making cashless payments for online shopping, payment gateways provide secure and convenient options.

- PayPal: A global favorite, PayPal is widely used for international transactions. With robust encryption and buyer protection, it’s a secure e wallet for online shopping.

- Dragonpay: Commonly used in the Philippines, Dragonpay provides options for cashless payments across e-commerce sites, with security features such as transaction monitoring.

P2P (Peer-to-Peer) Transfer Services

Peer-to-peer transfer services like InstaPay and PESONet offer cashless transfer options for sending money securely between e wallets and bank accounts.

- InstaPay: Available 24/7, InstaPay enables quick, real-time money transfers, making it an ideal choice for instant payments.

- PESONet: Best for high-value transfers, PESONet offers batch processing for more significant transactions, ideal for businesses and large transfers.

Precautions and What to Avoid

Knowing how to navigate cashless payments safely includes recognizing and avoiding scams. Here are some common online money transfer scams:

- Unusual payment requests: Always confirm the recipient’s identity before sending money.

- Time-sensitive demands: Fraudsters often create a sense of urgency to trick victims into sharing personal information.

- Suspicious offers: Be wary of promotions that seem too good to be true, especially if they require you to enter bank or e wallet details.

Why Tonik Is the Secret to Safe Cashless Payments

Looking for a secure and versatile e-wallet? Tonik’s got you covered. As the first digital-only bank in the Philippines, Tonik prioritizes your safety with top-notch encryption, biometric logins, and real-time fraud monitoring. Fully licensed by the Bangko Sentral ng Pilipinas and insured by the PDIC up to PHP 500,000, your money is always protected.

But Tonik isn’t just an e-wallet—it’s a full-service digital bank! Enjoy easy transfers, boost your credit with the Credit Builder Loan, finance big purchases with the Shop Installment Loan, and earn more with high-interest Time Deposits (up to 6%) and Stashes (up to 4.5% with a group).

Ready to make secure, cashless payments? Download the Tonik App and experience digital banking beyond the ordinary!