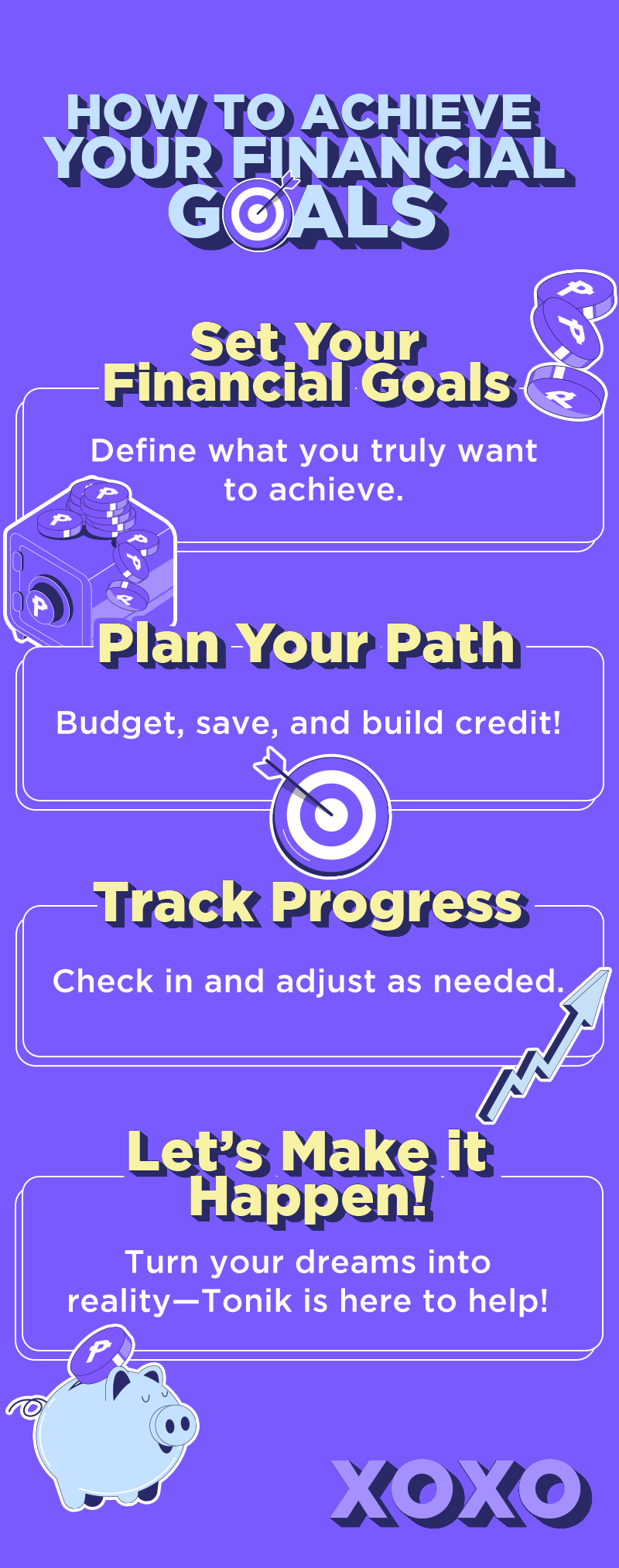

Got big financial dreams but not sure where to start? Whether it’s saving for that epic beach vacation or planning for a cozy retirement, setting and achieving financial goals is your ticket to making those dreams a reality. Ready to turn your financial wishes into achievable plans, luv? Let’s dive into how you can set smart goals and actually meet them.

Table of Contents

Understanding Financial Goals

Financial goals are more than just numbers. They're the milestones on your journey to financial freedom. Whether it's short-term goals like saving for a new laptop, or long-term aspirations like buying a home, each goal serves as a roadmap for your spending and saving habits. Understanding the "why" behind your goals can turn the mundane task of budgeting into a thrilling adventure towards your dreams.

Steps to Setting Realistic Financial Goals

Step 1: Identify What You Want to Achieve

First off, luv, you need to spell out what you really want. Pin down your desires—do you want to be debt-free, own a chic condo, or maybe build an emergency fund that’s as robust as your love for travel?

Step 2: Assess Your Financial Situation

Take an honest look at your finances—how much is coming in, how much is going out, and how much debt are you rocking?

Step 3: Set SMART Goals

When setting financial goals, make them SMART:

- Specific: Clearly define what you want to achieve.

- Measurable: Be able to track your progress.

- Achievable: Ensure the goal is within your reach.

- Relevant: Your goals should align with your long-term visions.

- Time-bound: Set a deadline to keep yourself accountable.

Strategies to Achieve Your Financial Goals

- Budgeting: Think of your budget as your financial BFF, keeping you on track and telling you when you’re splurging a tad too much—because even retail therapy needs a reality check!

- Saving: Kick your savings plan into high gear and ensure those funds are put away for a rainy day or a sunny escape.

- Build Credit with Tonik Credit Builder: If boosting your credit score is on your to-do list, Tonik’s Credit Builder is your go-to. Tailored for those who might not have a lengthy credit history or who are polishing their credit scores, this special loan allows you to borrow up to PHP 20,000 directly through your Tonik App within just two days. It’s designed not just as a financial boost but also as a stepping stone to a healthier credit status.

- Investing: Let your money flex its muscles by investing. It’s not just for big-timers, hun. With the right investment choices, you could be growing your wealth while you sleep!

- Monitoring Progress: Keep a close eye on your progress. It’s like watching your favorite series—you don’t want to miss a beat! Regular check-ins help you adjust your plans and stay pumped about your financial goals.

Let’s Achieve your Financial Goals Together, Luv!

Setting and achieving financial goals isn’t just about making plans—it’s about changing your life, one smart financial decision at a time. So, what are you waiting for, luv? Dive in, set those goals, and watch as your financial health transforms. And remember, we’re always here to make it a little easier.