Every International Women’s Month, I find myself thinking back to a time when I was still figuring things out financially.

Hey, I may be the CFO of a digital bank today with a long career in financial institutions—but I’m still human!

I remember all those times when I felt lost, or made decisions that probably weren’t the best for my financial well-being. Luckily, aside from my own research, I had mentors, family, and friends who nudged me in the right direction.

Then I think about the women who don’t—or have never had—that kind of guidance. Everyone who knows me knows how passionate I am about financial education. And since I can’t personally walk up to every woman I meet and share financial tips for women like I wish I could, I’ve decided to write this blog instead.

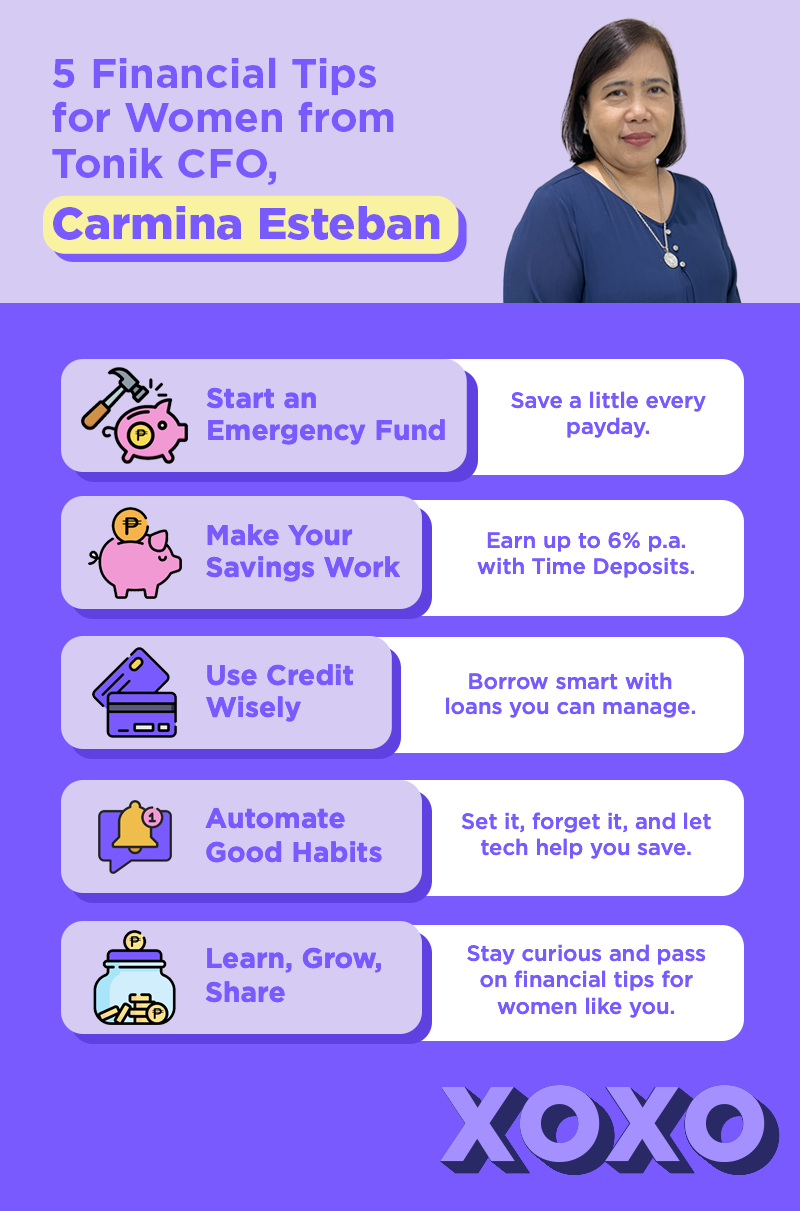

Hi, luv. I’m Carmina Esteban, CFO of Tonik Digital Bank, and here are 5 financial tips from yours truly.

Table of Contents

Start an Emergency Fund

I get it. Nothing beats a little retail therapy, especially when you’re spending money you worked hard for. Take it from me—a woman with a long list of books to buy and a family of cats to feed.

But before you spend that cash every payday, make sure you set aside a little for those rainy days. You never know when you’ll need it. It doesn’t have to be a huge amount right away. Start small. Eventually, it’ll grow, and your future self will thank you.

To avoid the temptation to spend it, stash it away in a Tonik Stash. Pro tip: name it according to its purpose so you don’t forget what you’re saving for!

Make your savings work overtime.

Even in this modern age, you’d be surprised how many people are still suspicious of banks—especially digital ones. Some still prefer to keep their money at home.

But storing your money that way won’t make it grow. In fact, it could burn to ashes - literally. Save it where it’ll be safe and where it can grow. Don’t know where to start? Open a Tonik Time Deposit. You can open up to 5, each earning 6% interest p.a.

Use credit to build—not break—your budget.

I spend a lot of my downtime reading the news and basically just catching up with what’s going on in the world. It breaks my heart every time I see an article about Filipinos struggling with debt.

If you’re thinking of taking out a loan, use it wisely. Borrow only what you need—and make sure it’s within your means. And please, don’t get a loan for things that can wait. If it’s not urgent, save up for it instead.

If you do decide to borrow, make sure the monthly installments won’t strain your budget. Paying on time consistently can help you build a good credit score, which opens more opportunities in the future.

Need a place to start? Try our Credit Builder Loan, designed to help improve your credit score while keeping payments manageable. Got a big purchase in mind? The Tonik Shop Installment Loan lets you pay over time—without the stress. You can also talk to your employer if you need financial help. They may have a partner like Tendo by Tonik who provides benefits to employees like life insurance and salary loans.

Automate your good habits.

We live in a techy world, so let your apps do the heavy lifting. Set up auto-debits for savings. Track expenses. Play with your own money data. Pro tip: I use Power BI to visualize my budget—it’s surprisingly satisfying!

However, don’t feel pressured to go high-tech. If a simple spreadsheet or notebook works better for you, stick to that. What matters is consistency, not complexity.

Learn, grow, share.

Financial independence isn’t about having it all figured out. It’s about staying curious, learning as you go, and sharing what you learn along the way – even when it’s not International Women’s Month.

Read books. Follow finance blogs. Ask questions. And when you pick up a useful money tip—especially those financial tips for women that aren’t always taught—pass it on. Just like I’m doing here. That’s how we grow together.

Bonus Tip: Start Banking with Tonik

If you’re like me back then—figuring things out, making mistakes, and learning as you go—know that there are tools out there to make the journey easier.

The Tonik App is built to help women like you take control of your finances, whether you’re saving, borrowing, or just starting to build healthy money habits. It’s packed with features that support real-life financial tips for women, all in one easy-to-use app. Download the Tonik App today!

Now if you’ll excuse me, I've got work to do. Take care, luv. You’ve got this! XOXO