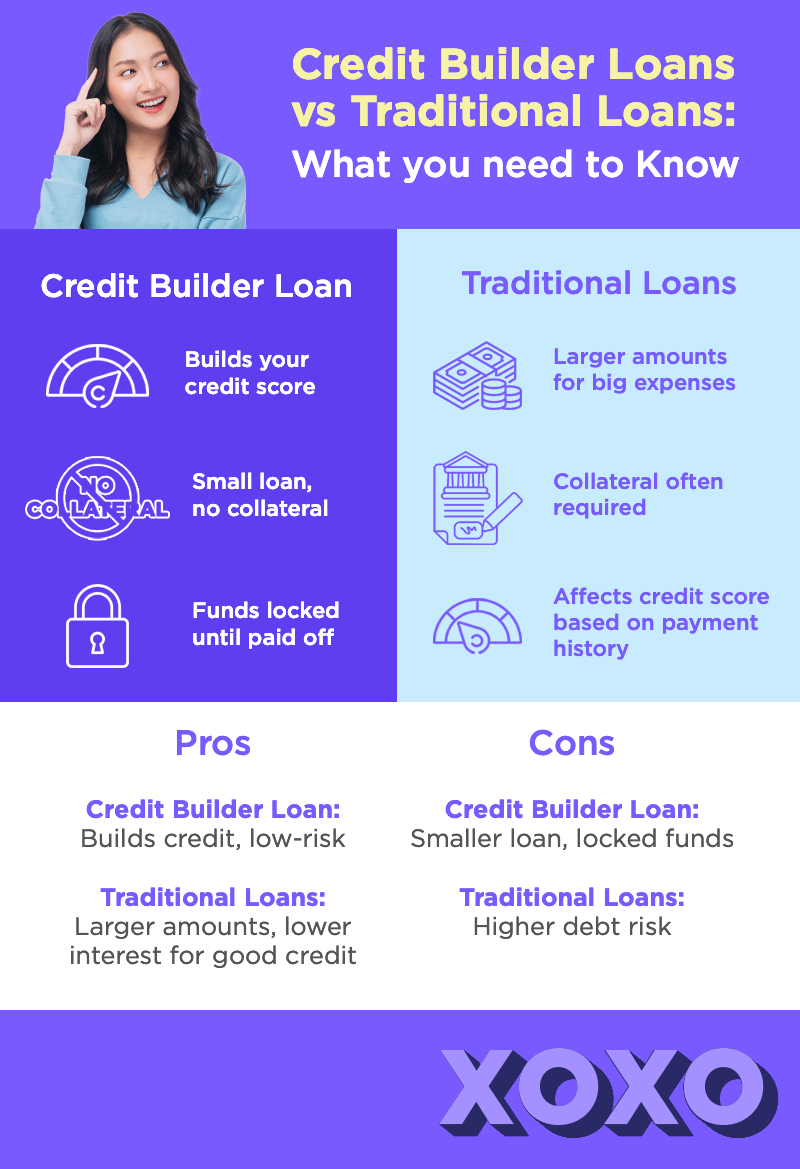

Credit Builder Loan

- Helps improve your credit score.

- Smaller loan amounts, no collateral needed.

- Funds are held until the loan is fully paid.

Traditional Loans

- Larger loans for significant expenses.

- Often require collateral.

- Impact credit score based on payment history.

If you’re looking to take control of your finances and build a solid credit history, you’ve likely heard about credit builder loans. But how do they stack up against traditional loans? Let’s break it down and see how a Tonik credit builder loan can be your secret weapon in achieving better financial health.

Table of Contents

What is a Credit Builder Loan?

A credit builder loan is a type of loan designed to help individuals build or improve their credit score. Unlike traditional loans where you receive the funds upfront, with a credit builder loan, the amount you borrow is held in a savings account or certificate of deposit (CD) while you make monthly payments. Once the loan is fully paid, you get access to the funds.

How do credit builder loans work? Typically, you borrow a small amount (between ₱5,000 to ₱20,000) and make regular monthly payments. These payments are reported to credit bureaus, helping improve your credit score over time, even though you haven’t received the money directly.

Traditional Loans in the Philippines

In the Philippines, traditional loans come in several forms:

- Personal Loans: Unsecured loans for any purpose like emergencies or consolidating debt.

- Auto Loans: Specifically for purchasing a vehicle.

- Online Loans: Fast, short-term loans available through digital platforms.

- Mortgages: Loans used to purchase real estate, typically secured by the property itself.

Traditional loans are generally used for big-ticket items or life-changing events like buying a home, paying for education, or consolidating high-interest debts. These loans typically offer larger amounts, making them ideal for large purchases or significant financial commitments.

Key Differences Between Credit Builder Loans and Traditional Loans

Collateral Requirements: A credit builder loan typically doesn’t require collateral, making it easier for those with no or low credit to access.

In contrast, traditional loans often require collateral, such as a house or car, especially for larger loans, which can be risky if you fail to repay.

Impact on Credit Score: A credit builder loan is specifically designed to help improve your credit score, and your timely payments are reported to credit bureaus.

On the other hand, traditional loans can affect your credit score depending on whether you repay on time or miss payments, but they’re not necessarily geared toward building credit.

Loan Access and Approval Criteria: Approval for a credit builder loan is typically easier since the loan is smaller and focuses on helping you build credit, rather than borrowing large sums.

For traditional loans, approval requires a good credit score, stable income, and sometimes, collateral, making them harder to qualify for.

Benefits of Each Loan Type

Benefits of Credit Builder Loans: A credit builder loan is perfect if you’re starting from scratch or looking to repair your credit.

It offers low entry barriers, no collateral requirements, and helps build your credit score without the risk of debt overload.

Plus, it’s a great way to develop healthy borrowing habits with minimal financial stress.

Benefits of Traditional Loans: Traditional loans, on the other hand, offer the flexibility to borrow larger amounts, which can be used for various purposes like purchasing a car, paying tuition fees, or funding a home renovation.

They also come with the potential for lower interest rates, especially for individuals with excellent credit.

Potential Drawbacks

Drawbacks of Credit Builder Loans: The biggest downside of a credit builder loan is the smaller loan amount, which might not be enough for larger expenses.

Additionally, you don’t have immediate access to the loan amount, as the funds are locked until you’ve completed the payments.

Drawbacks of Traditional Loans: Traditional loans often come with stricter qualification requirements and higher interest rates for those with less-than-perfect credit.

Additionally, borrowing large sums can lead to higher levels of debt, which can be challenging to manage without careful financial planning.

Choosing the Right Loan for Your Needs

When deciding between a credit builder loan and a traditional loan, consider your financial goals.

Are you looking to improve your credit score for future loans or simply need a large sum for an immediate purchase?

If you’re a first-time borrower or need help building credit, a credit builder loan from Tonik is an excellent choice to start your financial journey.

The Tonik Credit Builder Loan

If you’re looking for a safe, easy, and effective way to boost your credit, the Tonik Credit Builder Loan is the perfect solution.

With minimal requirements, low interest rates, and no collateral needed, you can start improving your credit score today while securing your financial future.

Ready to build your credit? Download the Tonik App now and apply for a Tonik Credit Builder Loan today!