Did you know? Your trusty car, bike, or the walls of your home are more than just everyday items, luv. They hold a secret power – to be your financial backup when you need it most. That's right, your beloved possessions can transform into financial lifelines. Your car is not just for commuting, and your home is more than just a living space… they are potential sources of cash in times of need.

But navigating title loans can be tricky. These loans may seem simple at first glance, but they come with important considerations you need to know about. That’s why we’ve come up with this guide to help you learn a thing or two about title loans. We'll clear up the confusion, explain the key details, and guide you on how to borrow smartly and safely.

Let’s get started, shall we?

Table of Contents

What are Title Loans and How Do They Work?

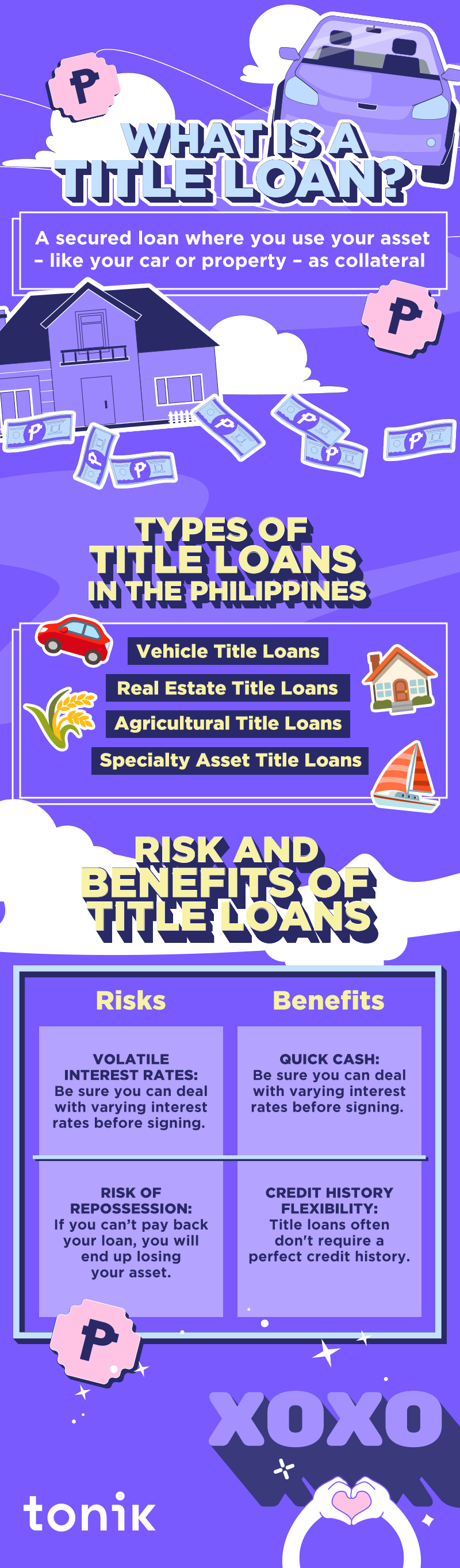

A title loan is a secured loan where you use your asset – like your car or property – as collateral. This means you give the lender the legal rights to your asset's title as a security blanket while you hold onto the actual asset.

You get a lump sum of money upfront based on the value of your collateral, and the beauty is, you still get to use your car or stay in your house while you repay the loan, luv. The lender holds onto your title, and once you've repaid the loan according to the agreed terms, your title is returned to you, no strings attached!

But here's where it gets technical: The amount you can borrow, the interest rate, and the repayment period are all determined by a risk assessment that considers the appraised value of your asset, your ability to repay, and the lender's policies. This means that no two assets are the same. It's a mix of valuation science and risk calculation, ensuring both you and the lender get the best deal.

TOCTypes of Title Loans Available in the Philippines

- Vehicle Title Loans: Your car, motorbike, or tricycle could be your ticket to cash. The loan amount is tied to the vehicle’s market value. Your business vehicles, whether they carry goods or people, can help you secure a loan, too.

- Real Estate Title Loans: Your home or land isn't just for show... it can unlock a cash flow. This includes residential or commercial properties.

- Agricultural Title Loans: Farmland can do more than yield crops; it can yield cash too. The loan value will vary based on land utility and crop potential.

- Specialty Asset Title Loans: Unique assets like boats or heavy equipment can also be used for loans. But these assets need to go through appraisal for value estimation before you can find how much you can borrow for them.

Pro tip: Keep your vehicle well-maintained to maximize your loan potential, luv!

Key Features and Terms of Title Loans

- Interest Rates: Think of interest rates as the spice level of your loan, luv. They determine just how hot the deal is. They can range from comfortably mild to seriously spicy, depending on factors like market conditions, your creditworthiness, and the lender's policies. That's why it's crucial to shop around. Compare rates from different lenders to ensure you get the best deal that doesn't burn your budget.

- Loan Duration: How long do you want to be in the ring with your loan? That's what loan duration is all about. You can opt for short-term loans that sprint across a few months or long-term loans that pace themselves across several years. Think about your cash flow and how quickly you can pay back the loan without gasping for air at the finish line.

- Loan-to-Value Ratio (LTV): This ratio compares the amount of the loan you're getting to the appraised value of your asset. If you have a high-value asset and a lower LTV ratio, you're likely to get more favorable loan terms. It's a delicate balance… too much of one thing can tip the scales.

How to Get a Title Loan in the Philippines

- Documentation: Gather your ID, proof of asset ownership, and any other required paperwork before starting.

- Application: Ready your pen or your laptops and fill out those forms with precision. Every detail counts, luv!

- Evaluation:Lenders will inspect your asset with a magnifying glass, assessing its value as if looking for hidden gems. They'll consider its market value, condition, and a host of other criteria to ensure it's a treasure worth lending against.

- Approval: After a thorough review, if your asset and papers are in order, you’ll get approved and the funds will be yours to use.

Risks and Benefits of Title Loans

| Risks | Benefits |

|---|---|

|

|

Ready to Get a Title Loan?

Title loans can bolster your finances when cash is tight. They're a useful tool, provided you use them wisely. Educate yourself, plan your budget, and make informed choices. And remember, if things get tricky, we’re here to help you ensure that your financial journey is as smooth as possible.

Most Popular