Taking out a loan? Or maybe you already have one! Well, paying your lender isn’t the only thing you sign up for. You also sign up for regular loan payment reminders. Banks usually send out these reminders to encourage good payment behavior. But there are definitely lenders out there that go over the top in their debt collection. In fact, collection agency harassment can happen to anyone.

By definition, collection agency harassment, aka debt collection harassment, is when lenders become incessant in their calls and demands for borrowers to pay their loan. Borrowers are therefore harassed, abused, and severely disrupted by these attempts.

Table of Contents

- Understanding Collection Agency Harassment

- Legal protection: What the law says

- Dealing with illegal lending practices in The Philippines

- The impact on borrowers

- Support for harassed consumers

- Fair and respectful collection: How we do it at Tonik Bank

- Avoiding online lending app harassment from the start

- How to deal with lenders proactively

Understanding Collection Agency Harassment

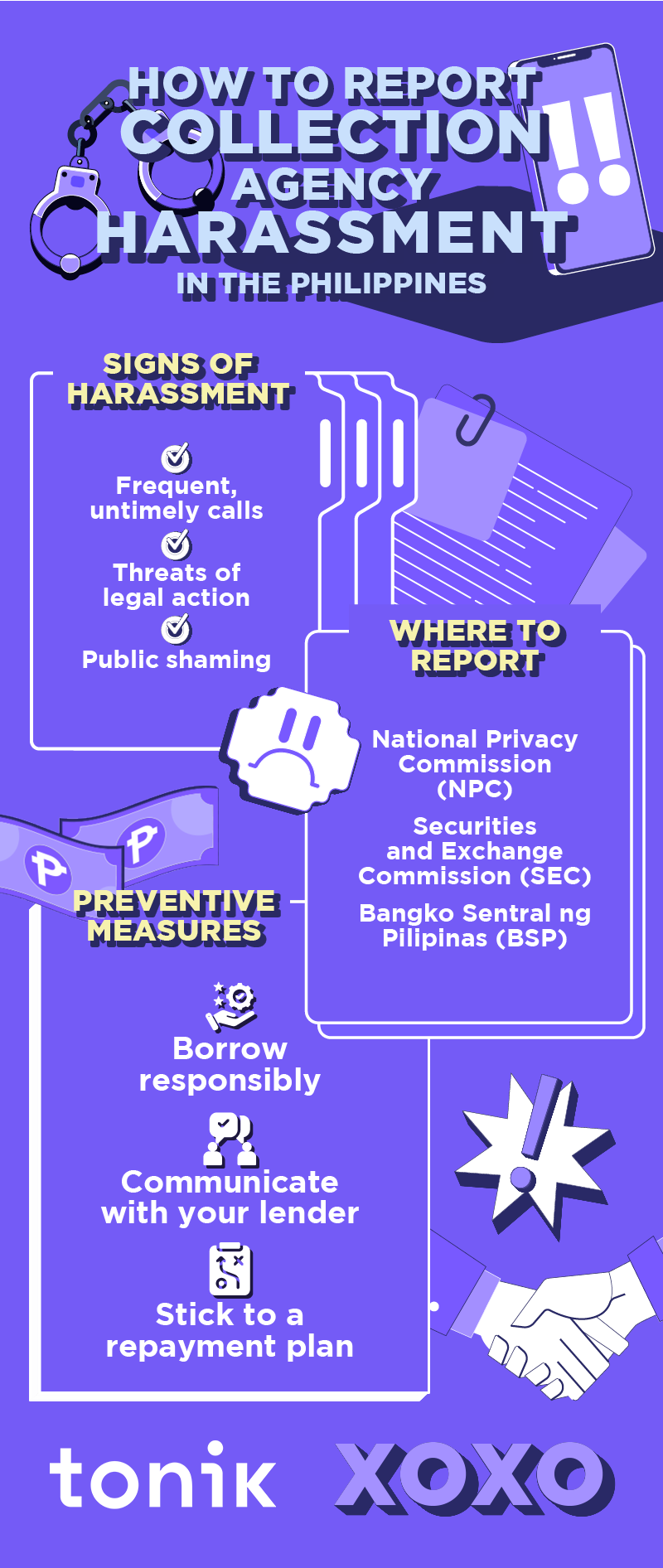

Harassment can come in different forms, and knowing what to watch out for is crucial. It can involve anything from constant phone calls to threats of arrest. If you’re getting calls at all hours, receiving threatening texts, or feel embarrassed because your debt information has been shared with others, these are red flags. These behaviors are illegal, and you don’t have to put up with them!

Common harassment tactics to watch out for:

- Frequent calls at odd hours – Some collectors will call repeatedly, even late at night or early in the morning, to pressure you. In The Philippines, the corporate regulator has stated that contacting borrowers before 6am or after 10pm isn’t allowed, unless the borrower has consented to be contacted at these times.

- Threats of legal action or jail time – A classic collection agency harassment method is when they scare you into thinking you’ll be arrested if you don’t pay. Remember that in The Philippines, nobody can actually go to jail because of debt.

- Public shaming – Somebody else publicly sharing your debt information on social media, or with your family or friends, is a violation of your privacy.

Legal protection: What the law says

Good news! The Philippines has several laws in place to shield consumers like you from harassment. Here’s a brief rundown:

- Republic Act No. 10173 (Data Privacy Act): Your privacy is protected under this law. Debt collectors are prohibited from sharing your personal details without your consent. This means they can’t tell your boss, your friends, or anyone else about your debt.

- Republic Act No. 9474 (Lending Company Regulation Act): This act regulates lending companies and ensures they follow ethical practices. Collectors must behave professionally and respect your rights.

- Implementing rules and guidelines by the SEC: The Securities and Exchange Commission (SEC) keeps a close watch on debt collection practices, especially with online lenders, to ensure they operate fairly and don’t engage in abusive tactics.

- Your rights as a consumer: As a borrower, you’re entitled to fair treatment. You have the right to privacy, the right to be treated with respect, and the right to report unethical behavior. If a debt collector is harassing you, there are steps you can take to protect yourself. In other words, collection agency harassment is in direct violation of several laws.

Dealing with illegal lending practices in The Philippines

Unfortunately, illegal lending practices in The Philippines are still prevalent, with many unregistered lenders operating outside the law. These rogue lenders often charge sky-high interest rates, use shady collection methods, and are guilty of online lending app harassment. Familiarize yourself with their ways so you don’t fall prey!

Common illegal lending tactics

- Unregistered lending companies – Always check if your lender is SEC-registered. If they’re not, they may not follow the rules, which will make their borrowers more vulnerable to collection agency harassment and even online lending app harassment.

- Exorbitant interest rates – Watch out for lenders charging rates that far exceed legal limits.

- Public shaming – No lender has the right to post about your debt on social media or inform your employer.

The impact on borrowers

Collection agency harassment tactics cause more than just financial stress. They can take a toll on your mental health, relationships, and overall well-being. But by knowing your rights, you can prevent these situations from spiraling out of control.

Reporting harassment and protecting yourself

If you’re facing harassment from a collection agency, don’t stay silent. There are channels you can go through to get help.

- Documenting the harassment: Start by keeping a record of everything. Log phone calls, save text messages, and take screenshots of any social media posts. This evidence will be crucial when you file your complaint.

- Where to report

- Concerned entity – If the entity is a bank and the harassment is made by bank personnel or collection agencies of the bank, raise your concern firstly with the entity concerned directly.

- BSP – If the lender is a bank or entity supervised by the BSP, and of whom you are not satisfied with the handling of your concern, file a complaint with the BSP.

- National Privacy Commission (NPC) – If your personal data is being shared without permission, contact the NPC.

- Securities and Exchange Commission (SEC) – If the lender is operating illegally or violating collection rules, report it to the SEC.

- How to file a complaint

- Filing a complaint about collection harassment is easier than you might think. Gather your evidence (screenshots, receipts, emails, etc.), prepare your documents, and submit your complaint

You should address it first and foremost to the bank concerned, lender, or collection agency online or in person. In case you are not satisfied with the handling of your concern, you may file a complaint with the regulatory bodies concerned, as applicable.

In case the concerned entity is directly supervised by the BSP, and your concern is not addressed by the concerned entity, you may send your complaint to BSP via the BSP Online Buddy (BOB) chatbot.

In the case of harassment by collection agencies/entities that are not directly affiliated with BSP or BSP-supervised institutions, you may report to the SEC by filing a ticket through the SEC Imessage Portal.

Whereas for data privacy concerns, you may report to the NPC. When reporting a complaint to NPC, print and fill out this form, have it notarized, and submit it in person, send via courier service, or scan and email it to complaints@privacy.gov.ph.

Support for harassed consumers

If you feel overwhelmed, remember that you’re not alone. There are non-profit organizations, legal aid clinics, and government bodies ready to assist you. The Public Attorney’s Office (PAO), for example, offers free legal advice and can help you take action.

Fair and respectful collection: How we do it at Tonik Bank

Tonik uses a transparent process for loan repayment reminders. You can pick your due date with us, and we’ll send you reminders that are clear and straightforward. In fact, our reminders have been personalized for our customers, specifically because we want to help you build that good repayment habit. You may think that we’re LUVbombing at first but we send reminders as a series to make sure our clients don’t miss a repayment that they agreed to.

If you encounter emergencies that are hindering you from paying your loan, you can contact our Collections team so that you can make payment arrangements subject to their approval. Your financial journey matters to us, and we’re committed to treating you with the dignity you deserve.

Avoiding online lending app harassment from the start

The best way to avoid collection agency harassment is to stay proactive with your debt management, whether you’re borrowing from someone you know, a bank, or an online lending app.

Tips for managing your debt

- Borrow responsibly – Only take on debt that you know you can repay.

- Create a payment plan – Stick to a repayment schedule to stay on track.

- Communicate with your lender – If you’re facing difficulties, let your lender know early on. Most lenders will work with you to find a solution, including Tonik Bank!

How to deal with lenders proactively

Keep lines of communication open, document all interactions, and always be aware of your rights. Staying informed and organized will help you avoid any misunderstandings or potential collection agency harassment down the line.

Ready to bank with Tonik? Download our app and start our neobanking romance today!

Sources:

- Respicio, A. (2023). Debt Collection Harassment in the Philippines: Legal Protections and Remedies. Retrieved from https://www.respicio.ph/commentaries/debt-collection-harassment-in-the-philippines-legal-protections-and-remedies

Consumer Financial Protection Bureau (CFPB). (n.d.). What is harassment by a debt collector? Retrieved from https://www.consumerfinance.gov/ask-cfpb/what-is-harassment-by-a-debt-collector-en-336/