If there’s one thing we can all agree on, it’s that waiting is kind of a drag. Waiting for that new single to drop, waiting for the new season of your favorite show to come out, and – arguably the worst of them all – waiting for payday to arrive.

The last one’s especially true if you’ve got emergencies to pay for. Hospital bills, for example, can’t wait until the 15th or the 30th of the month. You’ve got to pay them now.

Luckily, you don’t always have to wait for payday. That’s because there’s this little financial solution that you can apply for called payday loans!

What are payday loans? How do they work? How can one get them? The answers to your questions are in this quick little blog, so read on, luv, and learn all about payday loans!

Table of Contents

What are Payday Loans?

To put it simply, payday loans are short-term loans that provide quick access to cash. They’re typically unsecured, meaning you don’t have to pledge property to secure one.

They are typically used to cover unexpected expenses and bridge the gap between paychecks. They also go by other names like cash advances, salary loans, or quick cash loans.

TOCHow Payday Loans Work

Now that you get the gist of payday loans, let’s talk about how they work. Here’s a quick breakdown, plus a few pros and cons to help you decide if they’re for you.

- Eligibility Criteria for Borrowers – Lenders in the Philippines typically require borrowers or debtors to be of legal age, have a stable income, and a valid ID. This varies from lender to lender, so make sure you have what your chosen lender requires before applying.

- Terms and Conditions - Payday loans in the Philippines come with varying interest rates and repayment periods. Be sure to read and understand the loan terms before borrowing. If there’s anything you don’t understand, ask for clarification. There’s no shame in asking for help, luv!

- Disbursement and Repayment Methods - Payday loan funds are often disbursed through bank deposits or in-person. Repayment can be done through post-dated checks, online transfers, or payment centers.

Can’t Wait for Payday to Cover the Bills?

Check out awesome loan offers from Tendo by Tonik with your employer today!

The Pros and Cons of Payday Loans

Pros

- Quick Access to Cash – As mentioned earlier, payday loans provide a speedy solution for urgent expenses when you're short on cash!

- Minimal Eligibility Requirements - Getting approved is often easier compared to traditional loans. Usually, all you need is a steady income and a valid ID.

- No Collateral Required – Again, most payday loans are unsecured, meaning you don't need to put up collateral. You won’t need to worry about your lender seizing your property if you fail to pay back the loan! However, that’s not to say that you can afford to be irresponsible. Make sure you borrow only what you can pay back, and that you’re borrowing with the best intentions!

Cons

- High Interest Rates - Payday loans can come with steep interest rates, making them costly in the long run. This could be a deal breaker to some.

- Debt Trap Risk - Some borrowers get caught in a cycle of debt, borrowing repeatedly to cover previous loans. Prevent this from happening by being a responsible debtor. Before you apply, ask yourself: Do you really need this money now? If the answer is no, it’s probably best to wait for payday instead of getting a payday loan.

- Limited Loan Amounts - Loan amounts are usually small, so they may not fully cover substantial financial needs. If you need more cash than what payday loans typically offer, you should consider other options.

How to Get a Payday Loan in the Philippines

Like any other loan, lenders won’t simply hand out payday loans like they’re free samples at the mall. You need to follow a couple of steps to ensure a quick and smooth loan journey!

Step 1: Choose a reputable lender - Start by researching and selecting a trustworthy payday loan provider. Look for reviews and customer feedback to ensure they are reliable and transparent. You can also check their website if they’re accredited by the Securities and Exchange Commission.

Step 2: Complete the application form - Fill out the lender's loan application form. You'll need to provide personal information, contact details, and the desired loan amount. If you’re applying for a legit BSP-licensed neobank like us, this part’s going to be a piece of cake!

Step 3: Provide the required documents (ID, proof of income) - Submit necessary documents, which typically include a valid ID (such as a driver's license or passport) and proof of income (like payslips or employment certificates).

Step 4: Wait for loan approval - After submitting your application and documents, the lender will review your information and assess your eligibility in a process called underwriting. Underwriting refers to the process lenders use to evaluate the risk of lending money to a borrower. During this process, underwriters analyze a lot of details about the potential borrower's financial health to decide if they should approve the loan, and if so, under what terms.

Step 5: Receive your funds - Once your loan is approved, you'll receive the loan amount in your chosen disbursement method, which can be a bank deposit, cash, or other options.

Step 6: Repay the loan on the agreed-upon date - Be sure to make payments according to the terms of your loan agreement. This usually involves repaying the loan on the specified due date, either through post-dated checks, online transfers, or in-person at payment centers.

Pro tip: Get familiar with your lender’s repayment process and policy to make sure you don’t miss out on your due date. Should any emergency prevent you from paying on time, check or ask to see what their SOPs are on this.

TOCPayday Loan FAQs

How much can I borrow with a payday loan?

Loan amounts vary but are typically based on your income and the lender's policies. We know we sound like a broken record at this point but remember to borrow only what you can repay!

What do I need to qualify for a payday loan?

The list of requirements is different per leader. At the very least, you should have a steady source of income and a valid ID.

How quickly can I get a payday loan?

In many cases, you can get funds on the same day. Lenders have varying processing times, so try to look for one that can disburse your funds as soon as possible if you’re in a hurry. You can also speed things up if you have the right and complete requirements!

What is the interest rate on a payday loan?

Interest rates differ among lenders. Look for one that has the lowest interest rates to offer so you don’t end up paying a fortune!

Are payday loans available to people with bad credit or no credit?

Some lenders cater to borrowers with poor or no credit. Learn more about bad credit loans if you want to borrow funds and improve your credit score at the same time!

Can I get a payday loan without a credit check?

Some lenders offer "no credit check" loans, but they often have higher interest rates.

Is a Payday Loan Secured or Unsecured?

Payday loans are typically unsecured, meaning you don't need collateral.

How do I repay a payday loan?

Lenders offer various repayment options, such as post-dated checks, online transfers, or payment centers.

What happens if I can't repay my payday loan when it's due?

Late payments may result in additional fees and a cycle of debt. This may also damage your credit score, making it more difficult for you to secure another loan in the future.

Are payday loans regulated in the Philippines?

The Philippines has regulations to protect borrowers. Trust only legit lenders that are licensed by the BSP and are accredited by the SEC.

Why are payday loans often considered predatory?

High-interest rates and fees can trap borrowers in debt cycles. Be cautious when taking out payday loans and don’t overborrow to be on the safe side.

Are there alternatives to payday loans?

Explore alternatives like personal loans, borrowing from family or friends, or seeking financial assistance.

How does a payday loan affect my credit score?

Payday loans typically don't impact your credit score unless you default. Again, luv, don’t miss repayments!

Can I have multiple payday loans at once?

It's generally not advisable, as it can lead to financial strain. Get one loan at a time, and you’ll be good.

What should I consider before taking out a payday loan?

Assess your financial situation and explore other options before choosing a payday loan. Additionally, ask yourself first if what you’re borrowing for is indeed an urgent need. If not, then perhaps you should wait for payday instead.

TOCStay Financially Afloat with Payday Loans

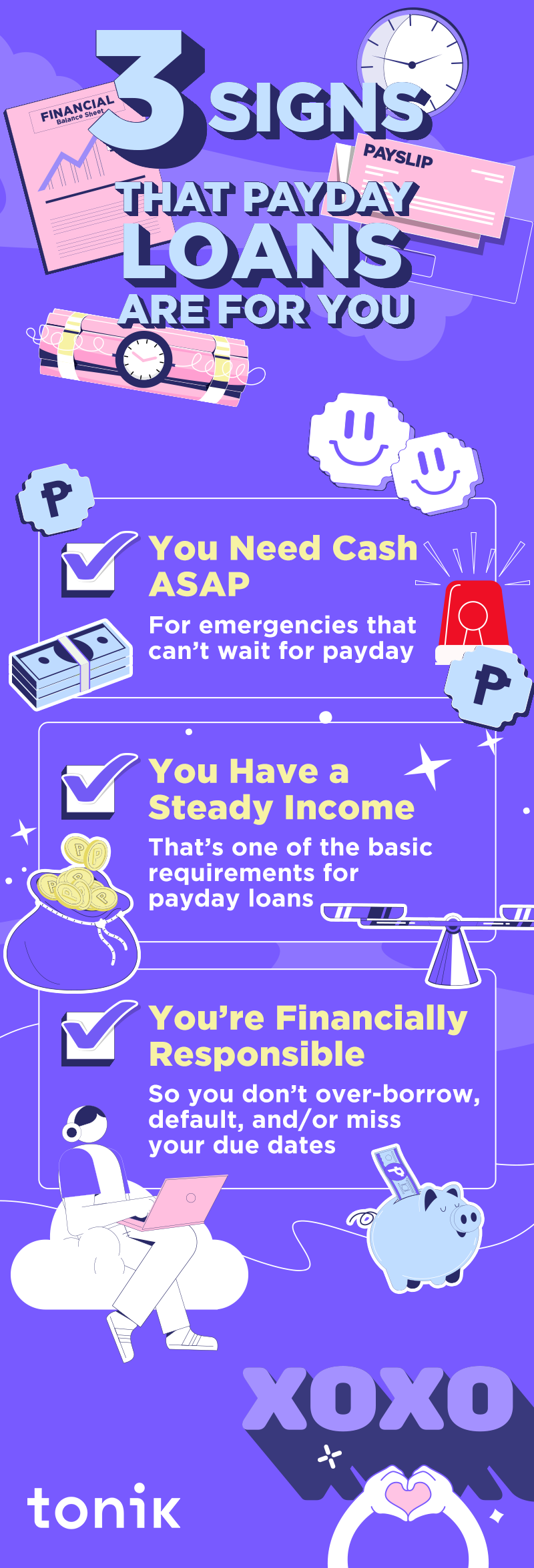

Here’s a final reminder before you go and take out a payday loan: carefully weigh the pros and cons, fully understand the terms, and explore alternatives before making this big commitment.

Additionally, if your financial health and goals don’t align with getting payday loans, then don’t. Payday loans shouldn’t just serve the purpose of paying for immediate needs. You should be looking at the bigger picture too!

Ready to take that payday loan? Then go for it! This blog will always be right here if you need quick answers. We’re rooting for you, luv. Download the Tonik App and apply today!