In an era where all things digital shape our everyday lives, the financial landscape has undergone a fascinating revolution, offering a variety of online lending platforms, each with its unique perks and specialties.

To help you decide which online lending platform fits your needs, we're taking a deep dive into the diverse range of lending options available in the Philippines. Whether you're seeking a loan for personal aspirations, entrepreneurial ventures, or niche needs, this guide serves as your map to navigate the exciting terrain of online borrowing.

Join us on this journey as we unravel the different online lending platforms, their benefits, drawbacks, and help you find the best fit for your financial aspirations.

TOC

Digital Bank Loans

Digital bank loans are the financial products offered by licensed digital banking entities. In the Philippines, such banks must be licensed by the Bangko Sentral ng Pilipinas to qualify as digital banks. Loans offered by digital banks are tailored to meet the digital age's demands, characterized by their accessibility and streamlined application processes.

On a mobile device? Swipe left to view full table

| Pros |

Cons |

- Instant Applications: Digital banks offer swift application processes, reducing the time between application and approval.

- Competitive Interest Rates: Digital banks often present competitive interest rates due to their streamlined operations.

- Convenience: Accessibility and convenience are key advantages for digital bank loans, allowing you to apply and manage loans entirely online.

|

- Limited Physical Presence: While convenient, digital banks lack physical branches, which some customers might prefer for in-person assistance.

- Internet Dependency: Access to a stable internet connection is vital for digital banks, making it a limiting factor for potential users in areas with poor connectivity.

- Eligibility Criteria: Some digital banks might have strict criteria, potentially excluding certain individuals from accessing their services.

|

TOC

Peer-to-Peer (P2P) Lending Platforms

P2P lending involves individual investors lending money directly to debtors through an online lending platform. These platforms act as middlemen to facilitate the loan process.

On a mobile device? Swipe left to view full table

| Pros |

Cons |

- Inclusive Lending Opportunities: P2P lending opens avenues for debtors who might not meet traditional bank criteria.

- Competitive Rates: These platforms often offer competitive rates due to reduced intermediary costs.

- Borrower-Friendly Terms: Borrowers can often find more flexible terms on P2P lending platforms.

|

- Security Risk: There's a risk of lending to unknown individuals, leading to risky lending and potential default.

- Varied Interest Rates: Interest rates can vary between lenders, making it harder to predict the final cost.

- Fluctuating Returns for Investors: For those investing in P2P platforms, returns can vary, posing a risk to the investment.

|

One great example of a P2P online lending platform is Blend PH. This platform focuses on helping borrowers connect to lenders and assisting individuals who may want to grow their wealth through investing.

TOC

Mobile Lending Apps

Mobile lending apps are designed for easy access to loans using smartphones. In short, they’re a type of online lending platform that you can borrow funds from on-the-go. They offer quick approval and disbursement, catering to individuals on-the-go.

On a mobile device? Swipe left to view full table

| Pros |

Cons |

- Swift Processing: Mobile apps offer quick processing, making it convenient for urgent financial needs.

- Minimal Documentation: These apps often require less documentation, streamlining the application process.

- Accessible: Providing access to loans at the convenience of the borrower's schedule and location.

|

- Higher Interest Rates: Often, mobile lending apps may have higher interest rates compared to traditional loans.

- Data Privacy Concerns: Users should be cautious about the security of their personal and financial information.

- Limitations on Loan Amounts: Loan amounts may be restricted compared to traditional loans.

|

Popular mobile lending apps include GCash and Maya. They extend easy loan access, leveraging their existing user base and digital payment infrastructure for hassle-free borrowing.

TOC

Online microfinance institutions focus on providing small loans and financial services to individuals or small businesses. They’re a form of online lending tailor-made for the underserved or financially excluded populations.

On a mobile device? Swipe left to view full table

| Pros |

Cons |

- Financial Inclusion: Microfinance institutions cater to the underserved population, fostering financial inclusivity.

- Support for Micro-entrepreneurs: Online microfinance institutions support small business growth and individual entrepreneurial endeavors.

|

- Higher Interest Rates: Interest rates might be relatively higher due to the higher risk associated with small loans.

- Limited Loan Amounts: Loan amounts could be restricted compared to traditional banking.

- Strict Repayment Schedules: Rigorous repayment schedules might pose challenges for borrowers.

|

RFC champions microfinance initiatives in the Philippines, enabling small businesses and individuals with access to financial aid for growth.

TOC

Fintech Company Loans

Fintech company loans refer to loans provided by non-traditional financial institutions that leverage technology to streamline the lending process.

On a mobile device? Swipe left to view full table

| Pros |

Cons |

- Innovative Loan Products: Fintech companies offer innovative and customized loan products.

- Expedited Processes: They provide quick and efficient loan processing.

- Customer-Centric Services: Services are often designed to be user-friendly and tailored to customer needs.

|

- Unfamiliarity with New Institutions: Users may be cautious because fintech solutions may be foreign or unfamiliar to most of them.

- Limited Physical Presence: Lack of physical branches may deter some users.

- Varied Service Quality: Quality might vary among different fintech companies.

|

TendoPay is a great example of a fintech company. They specialize in providing premium payroll-enabled financial services in the Philippines.

TOC

Online Personal and Consumer Loans

Online personal and consumer loans encompass diverse options like Buy Now Pay Later (BNPL), gadget loans, auto loans, and mortgage loans tailored for personal or household expenditures.

On a mobile device? Swipe left to view full table

| Pros |

Cons |

- Versatile Loan Types: Offer a range of loan types catering to diverse needs such as gadget loans, mortgage loans, etc.

- Diverse Repayment Options: This type of online lending typically offers flexible repayment options that suit different financial circumstances.

|

- Potential Overborrowing: Easy access to loans might lead to overborrowing and debt accumulation.

- Higher Interest Rates: Often, these loans come with higher interest rates compared to traditional loans.

- Risk of Impulsive Spending: Availability of quick loans might encourage impulsive purchases.

|

Our Shop Installment Loan offers online lending for gadgets and appliance needs for the entire family. Learn more about getting the lowest monthly payments with our Shop Installment Loan here.

TOC

Online Business and SME Lending Platforms

Online business and SME lending platforms cater to small and medium-sized enterprises, providing funding for business growth and expansion.

On a mobile device? Swipe left to view full table

| Pros |

Cons |

- Tailored Business Loans: This online lending platform offers loans specifically designed for small and medium-sized businesses.

- Quick Approval: Quick approval processes that help businesses with urgent financial needs.

- Less Stringent Requirements: Typically, they have fewer requirements compared to traditional bank loans.

|

- Potentially Higher Interest Rates: Interest rates might be higher compared to established banks.

- Limited Credit Amounts: Loan amounts might be limited, which could restrict business growth.

- Varied Repayment Terms: Different platforms might offer varying repayment structures.

|

First Circle is a leading online lending platform in the Philippines that offer fast and flexible business loans, empowering SMEs with financial solutions for their growth.

TOC

Crowdfunding Platforms

Crowdfunding, in the realm of online lending, encompasses various models including debt-based, equity-based, and reward-based funding, facilitated by online platforms.

On a mobile device? Swipe left to view full table

| Pros |

Cons |

- Diverse Funding Models: This online lending platform offers diverse funding models such as debt-based, equity-based, and reward-based funding.

- Potential Community Support: Engages the community in funding innovative projects.

- Non-traditional Funding Avenues: Provides alternatives to traditional borrowing or investment options.

|

- Variable Success Rates: Success in raising funds can be uncertain and dependent on various factors.

- Lack of Investor Control: Investors might have limited control over the project they invest in.

- Stringent Campaign Requirements: There might be strict requirements for running a successful crowdfunding campaign.

|

Investree operates as a crowdfunding platform, offering avenues for both debt and equity-based funding, providing a space for diverse investment opportunities in the Philippines.

TOC

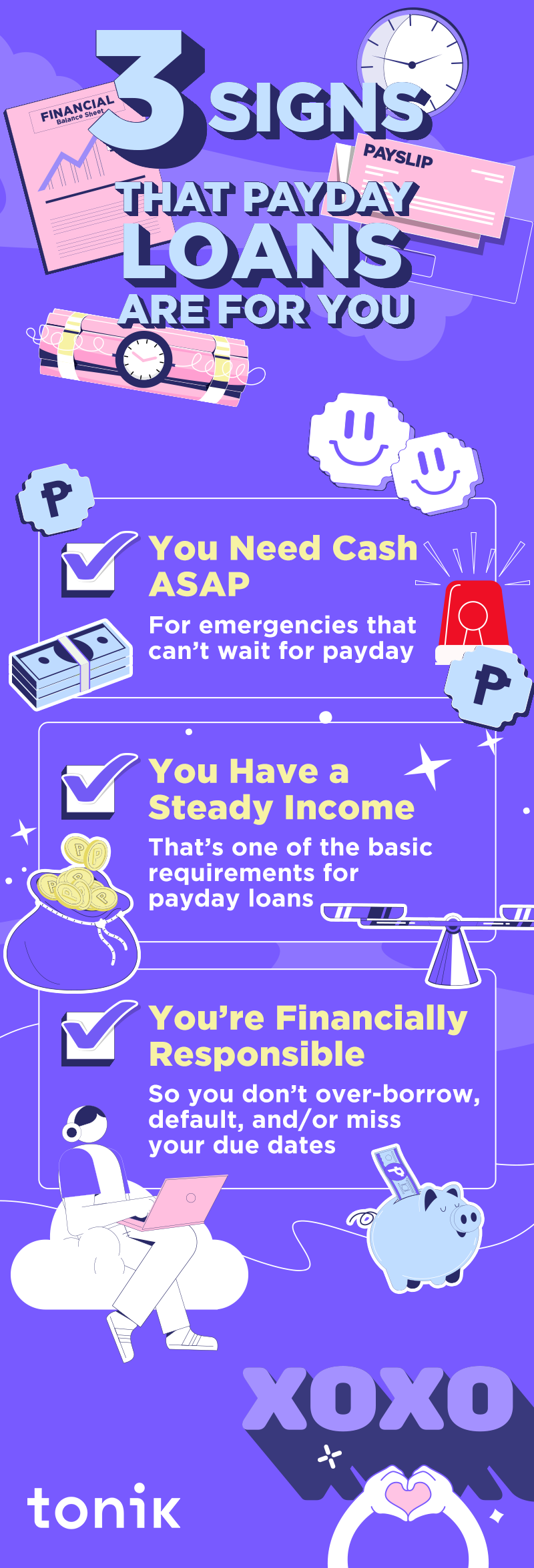

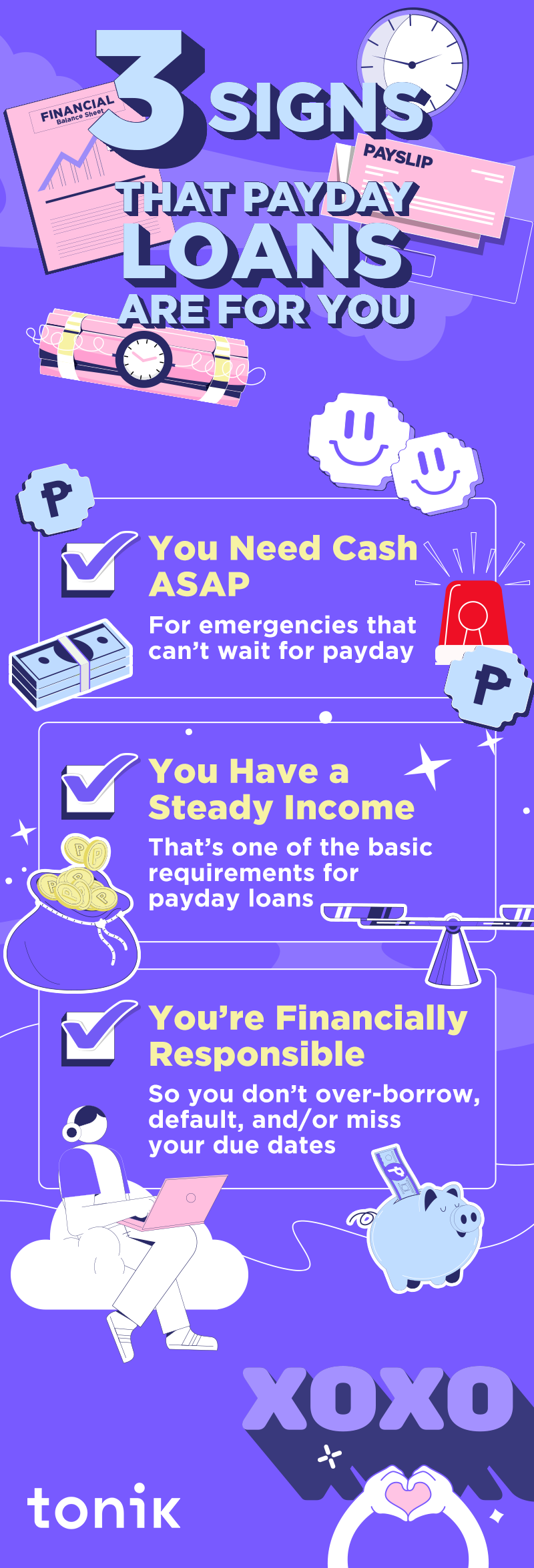

Payday Loan Platforms

Payday loan platforms cater to short-term borrowing needs, typically with swift approval and disbursement, intended to be repaid on the borrower's next payday.

On a mobile device? Swipe left to view full table

| Pros |

Cons |

- Quick Access to Funds: Immediate access to funds for urgent needs.

- Minimal Documentation: Online lending through payday loans are less stringent with documentation requirements facilitate quick loan processing.

- Easy Application Processes: User-friendly application processes for convenience.

|

- Higher Interest Rates: Payday loans generally come with higher interest rates than traditional loans.

- Potential Debt Cycles: High-interest rates might lead borrowers into a cycle of debt.

- Limited Loan Amounts: Loan amounts may be capped, restricting borrowing capacity.

|

Multiple platforms in the Philippines offer payday loans, catering to immediate financial needs. But be careful, luv! Some payday loans can be predatory and lead you to falling into the debt trap.

TOC

Blockchain-Based Lending Platforms

Blockchain-based lending platforms utilize blockchain technology to facilitate online lending, offering decentralized and transparent processes.

On a mobile device? Swipe left to view full table

| Pros |

Cons |

- Enhanced Security: Utilizes blockchain technology offering secure and transparent transactions.

- Reduced Fraud: Reduces the potential for fraudulent activities due to the transparent nature of blockchain.

- Transparent Transactions: Transactions on the blockchain are open and verifiable.

|

- Evolving Technology: Blockchain technology is still developing, leading to uncertainties for borrowers.

- Regulatory Concerns: Unclear or evolving regulations might pose challenges for these platforms.

- Limited Widespread Adoption: Not yet widely adopted, limiting accessibility.

|

Binance Loans and Abra Borrow are examples of platforms leveraging blockchain for lending, offering secure and transparent borrowing mechanisms in the Philippines.

TOC

Specialty Financing Platforms

Specialty financing platforms focus on niche markets such as medical loans, real estate financing, green energy, student loans, OFW loans, franchise loans, etc., catering to specific financial needs.

On a mobile device? Swipe left to view full table

| Pros |

Cons |

- Focused Niche Markets: Providing online lending options to specific markets such as medical loans, real estate, etc.

- Addressing Specific Needs: Serves specific sectors and communities with unique financial requirements.

|

- Potential Limited Accessibility: Limited reach due to specialized nature.

- Market Volatility: Certain sectors might experience higher volatility or risks.

- Regulatory Challenges: Some niche markets might face unique regulatory challenges.

|

Bukas PH is a specialty financing platform that caters to student loan needs, offering tailored financial products for educational pursuits in the Philippines.

TOC

Final Words

In conclusion, the diverse array of online lending platforms in the Philippines opens a myriad of options for individuals, businesses, and specific niche markets. It's essential to weigh the pros and cons, understand your needs, and choose the platform that aligns best with your financial goals.

Now that you are more familiar with the various online lending platforms in the Philippines, what are you waiting for? Download the Tonik App today on your smartphone! Grow your savings, apply for loans, and even get both virtual and physical debit cards. You can trust us, luv!

The evolving landscape of online lending and digital financial services calls for a standout digital bank, after all. And as the first neobank in the Philippines to get the first digital bank license from Bangko Sentral ng Pilipinas, you can count on us. Here’s to transforming the borrowing experience and fostering financial inclusivity across the Philippines together.

How much do you need?

Max amount ₱50,000

Choose an installment period

Your monthly

installments

Your monthly

installments

₱ 1,046.28

Actual amount may change