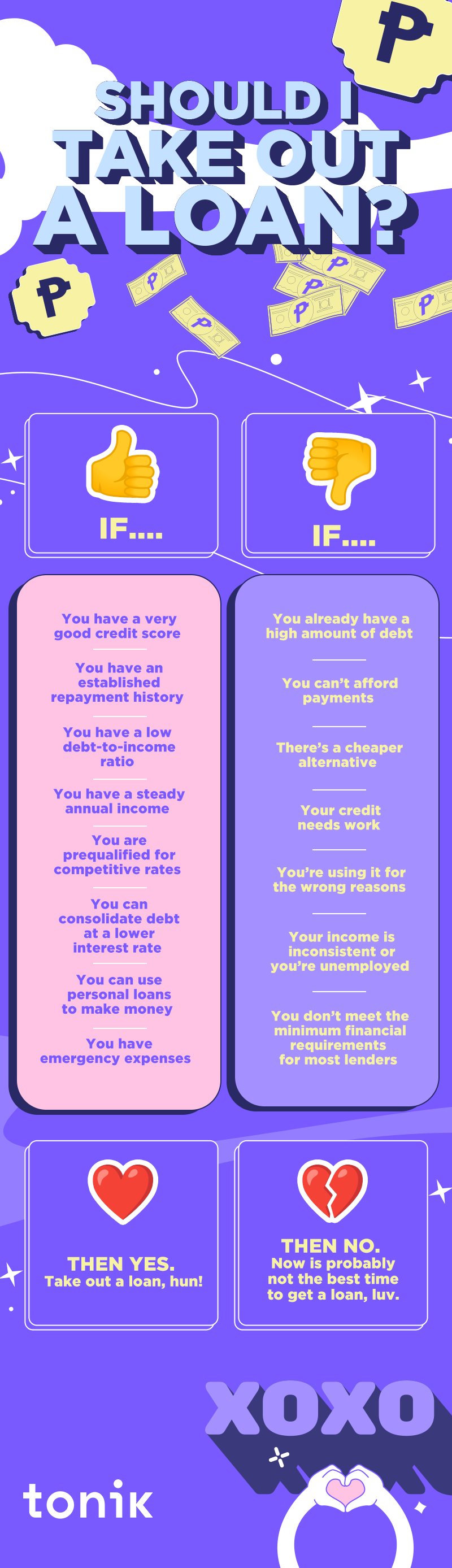

Just like any romantic journey, there is such a thing as perfect timing when it comes to taking out a loan. If you want to increase your chances of getting that coveted yes (by banks and lenders), then you need to master not just how but when to apply. After all, you can’t rush the important stuff, right?

So in this blog, we’re going to tell you everything you know about finding the perfect timing when applying for a loan. Be warned, luv. You’ve got to let your mind (and wallet) take the lead on this one.

Table of Contents

When to Get a Loan?

You have a very good credit score or above.

Your credit score is the unsung hero of the financial world. A high credit score not only opens doors to better loan options but also translates to lower interest rates. If your credit score is in the green zone, it's a signal to explore your loan options confidently.

You have an established repayment history.

Lenders love reliability, and your repayment history is a testament to your financial discipline. If you have a track record of paying bills on time and managing credit responsibly, you've built a strong case for loan approval.

You have a low debt-to-income ratio.

Lenders assess your debt-to-income ratio to gauge your ability to handle additional debt responsibly. If you're not drowning in debt and your income comfortably outweighs your financial obligations, you're in a sweet spot to consider a loan.

You have a steady annual income.

A stable income is the backbone of financial security. Lenders prefer borrowers with a consistent and sufficient income to ensure timely repayments. If your job or business provides a steady stream of income, you're ticking off another box in the loan approval checklist.

You prequalified for competitive rates.

Prequalification is like receiving a golden ticket in the financial realm. If you're prequalified for a loan with competitive interest rates, it's a sign that lenders see you as a trustworthy borrower. Seize this opportunity to secure favorable terms for your financial journey.

You can consolidate debt at a lower interest rate.

Sometimes, taking out a loan can be a strategic move to simplify your financial life. If you have multiple debts with varying interest rates, consolidating them into a single loan with a lower interest rate can save you money in the long run.

You can use a personal loan to make money.

Investing in opportunities that yield returns higher than the loan interest can be a savvy financial move. Whether it's starting a side business or investing in your education, using a personal loan as a financial tool to generate income can be a prudent decision.

You have emergency expenses you need to pay immediately.

Life is unpredictable, and emergencies don't always come with a warning. If you're faced with unexpected expenses that require immediate attention, a loan can provide the financial cushion you need to navigate through tough times.

TOCWhen is Getting a Loan a Bad Idea?

You already have a high amount of debt.

While managing some debt is a part of financial life, having an overwhelming amount can be a red flag. If you find yourself drowning in existing debt, taking on more may not be the solution. Prioritize reducing your current obligations before considering additional loans.

You can't afford the payments.

Before committing to a loan, evaluate your budget to ensure you can comfortably meet the repayment requirements. If the monthly payments strain your finances or leave you with little room for other essential expenses, it's a sign that the timing might not be right.

There is a cheaper alternative.

Loans come with costs, including interest rates and fees. Before jumping into a loan agreement, explore other options that might be more cost-effective. It could be saving up for a purchase, exploring grants, or seeking financial assistance from friends and family.

Your credit needs work.

If your credit score is in need of some TLC, it's advisable to work on improving it before applying for a loan. This means giving attention to your credit activity and monitoring its health. A higher credit score not only increases your chances of approval but also unlocks better terms and interest rates, saving you money in the long haul.

You're using it for the wrong reasons.

Not all reasons for taking out a loan are created equal. If you're considering a loan for non-essential purposes, it might be a signal to reassess your financial priorities. It’s not that you can’t spend for your wants, you just have to do so wisely.

Your income is inconsistent or you’re currently unemployed.

A steady income is the cornerstone of responsible borrowing. If your income is irregular or you're currently unemployed, taking on a loan may pose a significant financial risk. It's crucial to have a stable financial foundation before venturing into the world of loans.

You don’t meet the minimum financial requirements for most lenders.

Lenders have specific criteria for loan approval, including minimum income thresholds and credit score requirements. If you fall short of these criteria, it's advisable to focus on strengthening your financial profile before applying for a loan. Otherwise, you might fall prey to predatory loan practices that will just make you fall into the debt trap.

TOCIs Now the Perfect Time, Luv?

When it comes to personal finance, the right time to take out a loan depends on various factors unique to your situation. Here at Tonik Bank, we prioritize your financial well-being and aim to guide you towards informed decisions. That’s why we offer various products, from high-interest savings and time deposits to collateral loans that suit your needs.

Remember, a loan is a tool, and like any tool, its effectiveness depends on how and when it's used. By understanding the opportune moments and recognizing the red flags, you empower yourself to make financial decisions that pave the way for a secure and prosperous future.