Building your credit score is hard enough on your own, but it's even harder when you’re a mom. Not only do you have to worry about your own finances, but you have to think about your family’s finances, too.

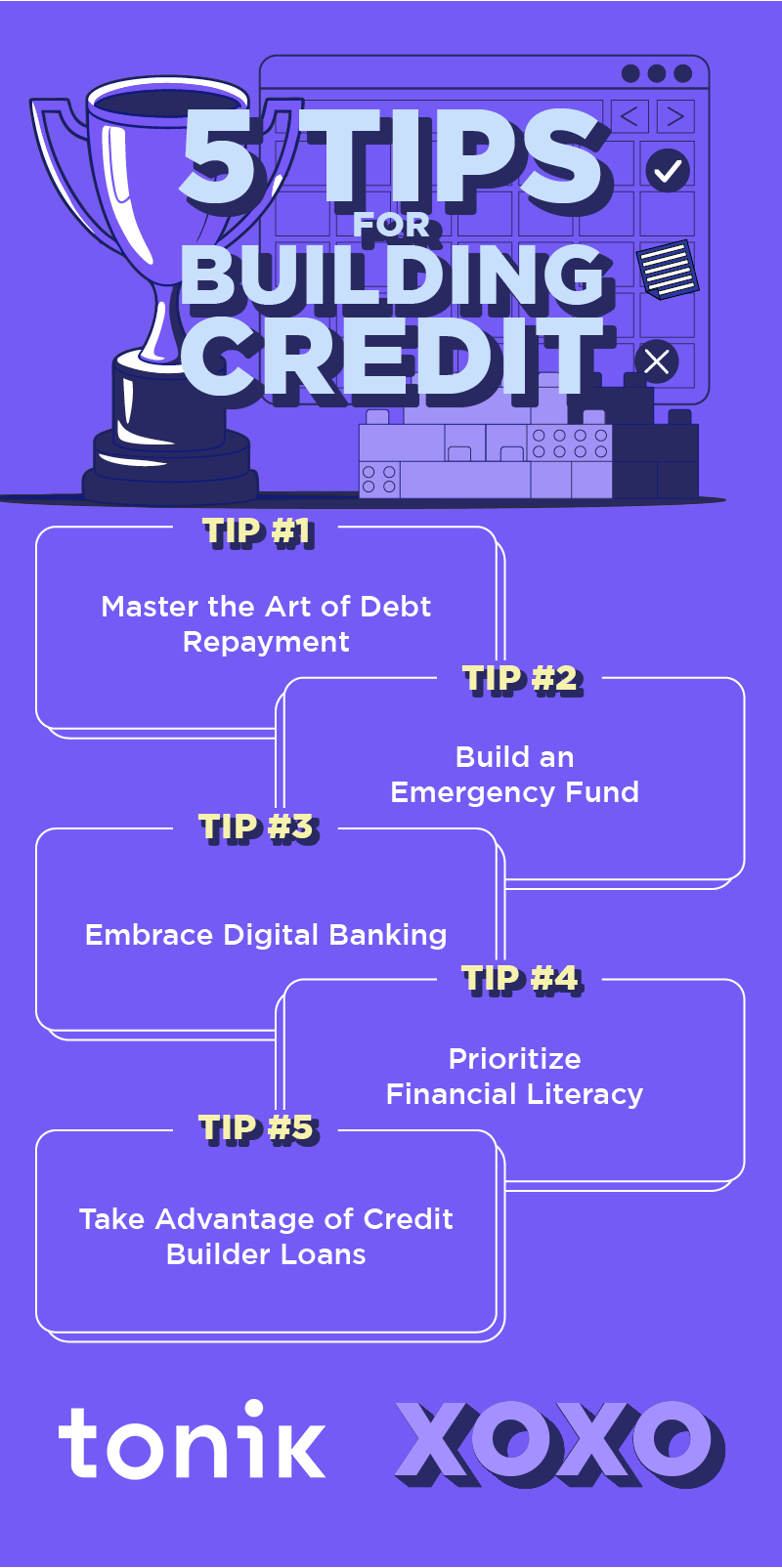

Despite that, The Millennial Mom does it well. How does she do it? Funny you should ask, because we’ve summarized five tips from our Build Credit with Me series right here!

Whether you’re married with children or single and ready to mingle, here are five credit building tips from the Millennial Mom!

Table of Contents

Tip #1: Master the Art of Debt Repayment

When it comes to debt repayment, slow and steady wins the race. Do that with this popular method called the Avalanche Method! This is where you focus on paying off debts with the highest interest rates first, so you save money in the long run.

If you prefer to start small and end big, try the Snowball Method. Why the “Snowball” method? Because it’s like a snowball rolling down a hill, getting bigger and bigger. Clever, right?

Whichever method you choose, just stick to it, luv!

Tip #2: Build an Emergency Fund

Life’s curveballs can make a dent on your credit score if you don’t prepare for them financially. That’s why, if you can, you should start an emergency fund!

An emergency fund is a certain amount of money you set aside in case of unexpected situations like income gaps and hospitalizations. WIth an emergency fund, you can rest assured that you can pay for these situations and make your debt repayments at the same time.

Rule of thumb: Save up three to six months’ worth of expenses in an account separate from your main bank account so you won’t accidentally spend it.

The Millennial Mom uses a Tonik Stash because not only is it customizable, but it can also earn up to 4.5%, or 5% if you’re doing it with a group!

Tip #3: Embrace Digital Banking

Time to trade those long lines and tedious paperwork for something more your speed—like a few taps on your phone!

Digital banking is here to make your life easier, helping you stay on top of bills, loans, your credit score, and savings goals all in one place.

With Tonik, you can manage everything through a single app—no more missed payments or forgotten due dates. So swipe right on digital banking and give your credit history that much-deserved TLC!

Tip #4: Prioritize Financial Literacy

Let’s get nerdy, luv. Understanding how credit works is the first step to mastering it, and trust us, a little financial know-how goes a long way.

Educate yourself on the factors that affect your credit score—like payment history, credit utilization, and the types of credit you use.

Keeping your credit utilization low (ideally under 30%) and making payments on time will keep your score looking sharp, too.

Tip #5: Take Advantage of Credit Builder Loans

If you’re new to credit or looking to give that score a little boost, a credit builder loan might just be your new best friend.

Tonik Credit Builder Loan offers up to P20K to help you establish or improve your credit score. And the best part? As long as you make your payments on time, you’re credit’s going to look amazing!

Ready to wow those future lenders, luv? Download the Tonik App and apply for a Tonik Credit Builder Loan today!